Zombie Economy Soon to Have its Zombie Epocalypse

From The Great Recession Blog

by David Haggith

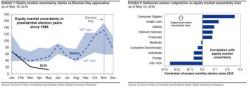

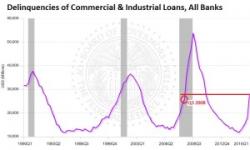

This past Thursday marked the one-year anniversary of the US stock market’s death when stocks saw their last high. Market bulls have spent a year looking like the walking dead. They’ve tried to push back up to that distant high that means new life several times, but each time the market falls into a pit again.