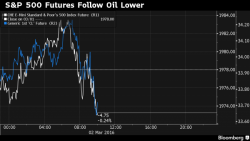

Can US Equities Go Green For The Year?

Via ConvergEx's Nicholas Colas,

With yesterday’s impressive equity rally, every trader is asking the same question: “Can U.S. equities go green on the year?” The S&P 500 is now down “just” 3.2% in 2016 and there’s nothing like a +2% one-day rally to hold out hope of actual gains before March 31.