"Mind The Gap" BofAML Warns The S&P Is At Crucial Support

"To double bottom or not to double bottom" asks BofAML's Stephen Suttmeier...

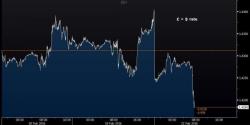

S&P 500 closes in on the big 1950 level

"To double bottom or not to double bottom" asks BofAML's Stephen Suttmeier...

S&P 500 closes in on the big 1950 level

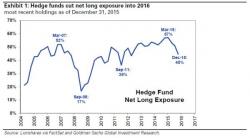

It has been a bad year for most markets. It has also been a bad year for those entities who collect 2 and 20 to "hedge" against bad years for markets: hedge funds. Unfortunately, as we have said since 2009, most hedge funds tend do anything but actually "hedge" which is why as Goldman's latest HF tracker reports, hedge funds have only modestly outperformed a weak S&P 500 YTD following their reduction in net long exposure to 45% at the start of 2016, the lowest level since 2012. Most are down for the year.

Unlike Monday's global PMI deterioration (which sent markets around the globe soaring), there was little in terms of macroeconomic data overnight (German IFO earlier missed on expectations and business climate but beat on current assessment) so the "market made the news." These came most from the USDJPY which has continued to fall, sliding to 111.85 overnight, and dragging the Nikkei to a -0.4% drop.

The overnight news was decidedly downcast, with first London mayor Boris Johnson voicing his support for Brexit leading to a collapse in the pound, validating our Saturday warning and then some, resulting in the biggest drop in cable in over a year over fears that the EU will lose one of its most critical members...

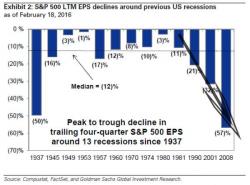

After refusing to even consider the possibility of a recession in the US for over a year, the first cracks in Goldman's armor are starting to appear. Over the weekend chief equity strategist David Kostin said that while the probability of a recession according to GS economists remains low, saying that "their model suggests the US has an 18% probability of recession during the next year and 24% likelihood during the next two years", Goldman's clients and investors "continue to inquire about the impact a contraction would have on the US equity market."