Deranged Central Bankers Are Blowing Up The World

Submitted by Jim Quinn via The Burning Platform blog,

Submitted by Jim Quinn via The Burning Platform blog,

Bad news is once again good news... for stocks that is.

After a month and a half of markets unable to decide if they should buy or sell on ugly data, over the weekend, People’s Bank of China Governor Zhou Xiaochuan expressed faith in the economy, and said there is no basis for further Yuan devaluation, something the PBOC has said consistently over the past year, despite two sharp devaluation episodes.

Excerpted from James Stack's InvesTech.com,

Technical Evidence: Confirming a bear market

With Q4 earnings season drawing to a close, here is a quick recap of the key issues facing corporate CEOs and CFOs based on their conference calls as summarized by Goldman's David Kostin: 1) Company managements forecast positive US GDP growth in 2016, in contrast with investor concerns of a potential recession. However, global growth prospects appear grim, particularly within commodity-exposed nations. (2) Strong domestic consumer demand persists amid industrial weakness. (3) Several firms announced large or accelerated share repurchase programs in 2016.

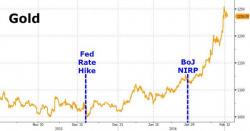

The move in gold, up 17% year to date, is important, according to ConvergEx's Nick Colas...

We’ll be blunt: most financial asset investors really hate gold.

Anything – even leaving money in the bank – is better than owning gold since at least society has access to your capital through the banking system. Once you buy physical gold, no one has access to that sliver of your portfolio.