Oilpocalypse Wow! Stocks, Bond Yields Plunge As Bank Risk Soars

What The Bank of Japan gives, The Japanese Finance Ministry taketh away...

Artist's impression of the last few days in crude, JPY, and US stocks...

What The Bank of Japan gives, The Japanese Finance Ministry taketh away...

Artist's impression of the last few days in crude, JPY, and US stocks...

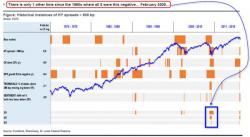

Are stocks cheap? Is the 'Stock-Market' "priced-for-perfection"? Here is your answer...

The answer is - Yes and Yes-er!

h/t @Not_Jim_Cramer

Simply put, the S&P 500's forward earnings based valuation has never (in the history of the time series) been higher relative to consensus expectations of economic growth... ever.

As we wrote yesterday when reviewing the latest note from JPM's Mislav Matejka, according to the JPM strategist not only had the window to buy stocks into the torrid S&P500 rebound closed, but traders should "start fading it within days" as JPM stuck "to the overriding view that one should use any strength as an opportunity to reduce equity allocation."

When it comes to Wall Street permabulls, no one name sticks out more than that of FundStrat's (formerly JPM's) Tom Lee. Which is why, when even the traditional CNBC host during market up days, turns modestly bearish as he has in recent weeks and admits the investing community is gripped by a "growth scare" it is a notable event. As he writes, "the S&P 500 has been struggling since the start of the year and markets remain extremely on edge given the multitude of risks facing the market."

It certainly does feel like groundhog day today because while last week's near record oil surge is long forgotten, and one can debate the impact the result of last night's Iowa primary which saw Trump disappoint to an ascendant Ted Cruz while Hillary and Bernie were practically tied, one thing is certain: today's continued decline in crude, which has seen Brent and WTI both tumble by over 3% has once again pushed global stocks and US equity futures lower, offsetting the euphoria from last night's earnings beat by Google which made Alphabet the largest company in th