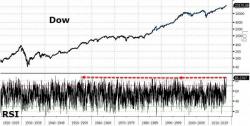

"Advanced Monetary Surrealism" Summarized In 60 Slides For Gold Bulls

For anyone who wasn’t included on the 1.5 million person distribution list for Incrementum AG’s latest 160-page annual tome on the gold sector, “In Gold We Trust”, the authors/portfolio managers, Ronni Stoeferle and Mark Valek, helpfully condensed the report into a chartbook containing "only" mere 60 charts. This can be viewed below, and as a courtesy for those short on time, here is our pick of the 14 best charts.