Energy stocks testing key breakout level, says Joe Friday

Just The Facts- Energy ETF (XLE) has lagged the S&P 500 by a large margin over the past three years, reflected in the chart below-

CLICK ON CHART TO ENLARGE

Just The Facts- Energy ETF (XLE) has lagged the S&P 500 by a large margin over the past three years, reflected in the chart below-

CLICK ON CHART TO ENLARGE

Authored by Kevin Muir via The Macro Tourist blog,

Another day, and another steady grind higher in US stock markets.

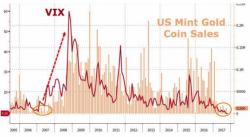

U.S. Mint Gold Coin Sales and VIX Point To Increased Market Volatility and Higher Gold

World stocks rose to a 4th consecutive record highs, while the dollar headed for its worst week; U.S. stock-index futures are steady, with European and Asian stocks higher ahead of much anticipated US inflation data, which is expected to give cues on the outlook for the Federal Reserve’s interest rates. MSCI’s all world equity index was up 0.1% after hitting record highs on Thursday. Earlier in Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan hit a 10-year high, up 0.3 percent on the day.

"The world is full of bubbles," warns former fund manager Richard Breslow but that shouldn't stop you from buying 'em. In the latest capitulation of a former realist, Breslow's confessional clarifies what many, many market participants clearly believe (and what Goldman called "unusually bullish"), "The reality is, you don’t have to like equities to buy them. And that will remain true until it isn’t. For now, beauty is in the eyes of the holder."