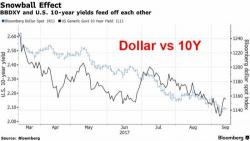

BofA: $2 Trillion YTD In Central Bank Liquidity Is Why Stocks Are At Record Highs

One week ago, in his weekly "flow report", BofA's Michael Hartnett looked at the "Disconnect Myth" between rising stocks and sliding yields and succinctly said that there is "no disconnect between stocks & bonds."

Why? The reason for low yields and high stocks was simple: trillions in central bank intervention. The result is an era of lower yields & higher stocks, or as the chart above shows, an era in which the alligator jaws of death are just waiting for their moment to shine. Here are the three phases: