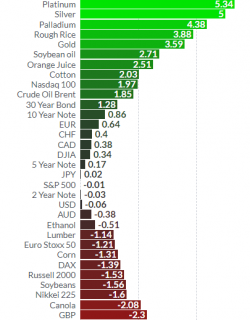

Precious Metals Outperform Markets In August – Gold +4%, Silver +5%

Precious Metals Outperform Markets In August – Gold +4%, Silver +5%

Precious Metals Outperform Markets In August – Gold +4%, Silver +5%

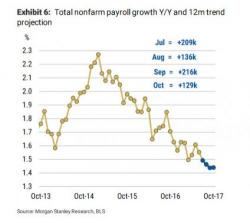

With payrolls looming (our full preview is here), carbon-based traders around the globe are leery of putting on any major trades and so the overnight session has been rather dull, dominated by the now traditional overnight algo-mediated levitation, which means the VIX is lower and S&P futures are once again modest higher as European and Asian shares continue their ascent.

The 'resilience' of stock markets is proclaimed as self-reflectingly positive, as they surge higher, enthusiastically embracing debt ceiling anxiety, nuclear armageddon, and biblical floods. However, below the surface all is very much not rosy...

As Bloomberg reports, this is a warning for stock traders entranced by a market that remains resilient to surprises. Even though the S&P 500 is less than 1 percent away from a record set this month, the best move is to wait out more selling, according to Strategas Research Partners.

Authored by Kevin Muir via The Macro Tourist blog,

There is this Canadian rock star who retired a few years back and took up hosting an afternoon drive-home radio show on a local Toronto station. Sometimes his program includes a segment called, “Damn! I wish I wrote that.” This ex-rock star will play a famous song on his guitar, tell the story of how it came to be, and then end with his great tagline.

Well, I am stealing his idea with my own segment called, “Damn! I wish I traded that!”

It's groundhog day as S&P futures, European and Asian shares all rise overnight, while the dollar is set to .