Jackson Hole'd - Dollar Dumps To 2-Year Lows After 2 Million Ounce Gold Flush

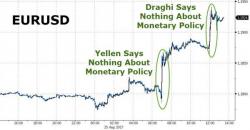

The dollar today...

Summarizing the week's moves: Dollar dump sparks buying binge in bonds, bullion, and stocks (but sinks FANG Stocks)

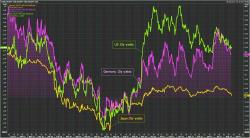

And this was what happened in FX markets...