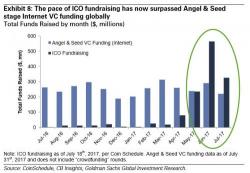

Bitcoin Spikes Over $3800 As Institutional Investor Interest Soars

Bitcoin is now up over 45% since the fork on August 1st, notably spiking this week (to a record high over $3800) as US-North Korea tensions escalated and both Fidelity (retail) and Goldman (institutional) noted investor interest in cryptocurrencies is soaring.

Fidelity announced Wednesday that it started allowing clients to view bitcoin and other cryptocurrencies on its website, a rare move for an established institution.