"From Nukes To Terrorism": Battered Investors Flee Risk For Safety Of Bonds And Gold

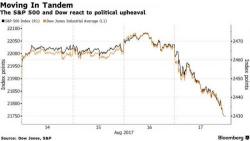

The global risk-off mood accelerated overnight on Trump "stability concerns", coupled with fallout from the Spain terrorist attack and lingering North Korea tensions, even if the VIX is off its latest highs, trading just above 15. Investors fled into German and U.S. Treasury bonds and bought gold for the third day in a row, as the appeal of such top-notch assets grew further due to a deadly attack that killed at least 13 people in Barcelona.