Morgan Stanley: "Well, That Escalated Quickly"

"Well, that escalated quickly."

"Well, that escalated quickly."

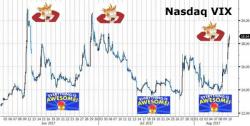

While so far the rout from the North Korea crisis has impacted global volatility first and foremost, with the VIX surging 50% (a rather pointless metric considering where the VIX was just days ago) on a modest drop in the S&P which earlier this week was making new all time highs, as massive short vol positions have been rapidly unwound, one trader believes the next place of impact is the sector which has so far emerged, so to say, largely unscathed from rising risk concerns: emerging markets, the clear outperformer so far in 2017.

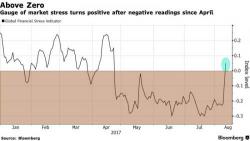

The global rout resulting from tensions over the North Korean nuclear standoff continued on Friday as world stocks tumbled for the fourth day, on course for their worst week since November following a third day of escalating verbal exchanges between Trump and Kim, as European and Asian shares tumlbed, volatility spiked, and the selloff in US futures continued albeit at a more modest pace as the escalating war of words over North Korea drove investors on Friday to safe havens such as the yen, Swiss franc and gold.

Amid today's turmoil, we are sure there will be another round of "this is it" calls (along with the ubiquitous "this is the dip to buy" narrative peddlers) and former fund manager Richard Breslow has had enough of this increasingly binary view of the world...

Via Bloomberg,

The investing world, like the real world, has sunk to the point where they see everything as digital.

With the VIX soaring, from single digits yesterday to over 15, risk is suddenly breaking out above the crucial Kolanovic redline level...

And Nasdaq is tumbling.

... it is worth reminding readers just how coiled the short-vol sector is, something we described two weeks ago in "If The VIX Goes Bananas" This Is What It Will Look Like" and in which a Morgan Stanley trader detailed how a devastating short vol unwind might develop: