The First Crack Appears In The Second Tech Bubble

By now everyone knows it: what is going on with a handful of tech stocks is remarkably similar to the irrationally exuberant events from the first tech bubble at the turn of the century.

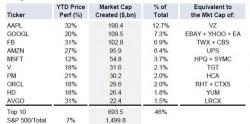

Four weeks ago, Goldman pointed out that in 2017, just 10 companies are responsible for half of the entire S&P's rally YTD with the top five, AAPL, FB, AMZN, GOOGL, and MSFT – have accounted for nearly 40% of returns.