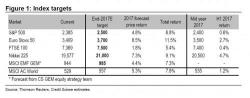

Credit Suisse "Climbs The Wall Of Worry", Raises S&P Target To 2,500 From 2,350

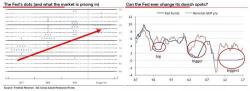

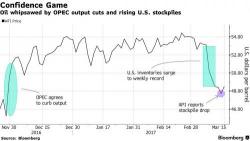

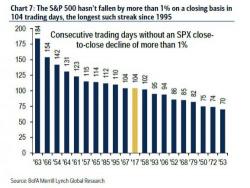

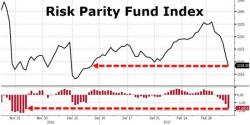

Following bearish reports from Goldman (which tactically downgraded stocks to Neutral for the next three months just hours before the Fed rate hike), RBC and JPM's head quant Marko Kolanovic over the past week, overnight Credit Suisse decided to take the other side of the trade and hiked its year end forecasts for the S&P500, and pretty much every other risk asset, noting that it is happy to "climb the wall of worry", and prefers equities to bonds.