Goldman: Investors Will Soon Realize They Were Too Optimistic

Goldman Sachs really wants the market lower.

Goldman Sachs really wants the market lower.

In an ironic twist of fate, it appears the catalyst for many of the biggest and most incomprehensible market ramps of the last few years is a fund called "Catalyst." With around $4 billion under management (before the latest collapse), the levered options fund is run by Edward Walczak who "uses options to create a better risk/return profile."

We have noted in the last few days the divergences between US equity and volatility markets and chatter of a major fund needing to liquidate positions. After today's price action (and more color from trading desks) we are starting to see the 'fingerprints' of what appears to be a multi-billion dollar forced short cover that has almost perfectly correlated with the linear surge in US stocks.

Here's RBC's Charlie McElligott to explain the details behind this move...

The global "risk on" melt-up continues.

After a modestly hawkish Yellen warned that every meeting is live, and refused to take March off the table, sending the dollar and yield higher and the S&P to fresh record highs, world stocks rose hitting a 21-month high on Wednesday with the dollar rising for the 11th straight day, the longest positive streak since July 2015.

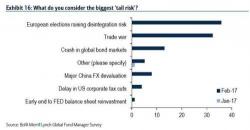

In the latest monthly Fund Managers Survey conducted by Bank of America, virtually none of the biggest "tail risks" noted by Wall Street's smart money (the 175 respondents to the survey collectively run a total of $543 billion) in February was touched upon in January, suggesting Wall Street has a whole new set of things that keep it up at night.

As the following chart shows, when asked what the biggest ‘tail risks’ are this month, 36% responded European elections raising disintegration risk; 32% said Trade war; while only 13% said "Crash in global bond markets."