JPMorgan Just Can't Stay Awake In This Market: "Nothing Is Changing The Equity Narrative"

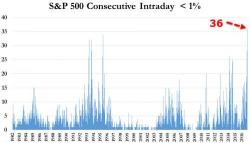

With nearly a record 40 days of the S&P not having an intraday swing of 1% or more, traders - desperate for volatility - are fuming at a market that has apparently flatlined. They are not alone: as JPM's Adam Crisafulli writes in his overnight piece, "it was once again a night of nothing", and no matter what happens, "nothing is changing the equity narrative", which for now is to barely budy on any given day.

Here is the key excerpt from JPM's (appropriately boring) overnight note: