"Not An Algo Was Stirring..." - Dow's Tightest Trading Range In 30 Years

You're welcome...

Twas the night before (the night before) Xmas, and all through the market, not an algo was stirring, not even a VIX cracker...

You're welcome...

Twas the night before (the night before) Xmas, and all through the market, not an algo was stirring, not even a VIX cracker...

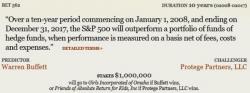

Nearly a decade ago, Warren Buffett bet Protege Partners, a fund of hedge funds, that over the course of 10 years the S&P would outperform Protege's returns net of all fees, costs and expenses. To make it real, the loser agreed to pay $1 million to the charity of the winner's choice.

At this past year's annual meeting, Warren Buffett provided an update on the now 8-year-old bet and, sure enough, the S&P has obliterated Protege's net returns by over 40%, on a cumulative basis.

Submitted by Lance Roberts via RealInvestmentAdvice.com,

I have written over the last couple of months the market was likely to rally into the end of the year as portfolio managers, hedge, and pension funds chased performance and “window dressed” portfolios for year-end reporting purposes. As I noted in this past weekend’s missive:

7th day in a row of hope for Dow 20k...

It's a real cliffhanger...

Before we start - 2 WTF Charts of the day...

This is the stock is best in The Dow this year...

Another day, another shot across the bow from Donald Trump aimed squarely at China.

Having already participated (and in the case of one, precipitated) two mini diplomatic snafus with Beijing in just the past two weeks, Trump is sending a clear message to Beijing that US-China trade under his administration will be anything but business as usual, by creating a National Trade Council inside the White House to oversee industrial policy and has decided to appoint a hard core China hawk to run it.