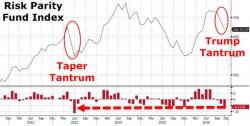

RBC Answers "THE" Question Every Investor Is Asking: "What Could Derail This Rally?"

As RBC's head of cross asset-strategy, Charlie McElligott, asks rhetorically in a note on Friday morning, “THE” question that every investor (across all asset classes and strategies) is asking remains this: when is “the gig up” with this reflation trade?, as we know this violent pace can’t last forever, and price trajectories in same cases exceed even the most optimistic expectations of the future state of the world.

Here is his answer: