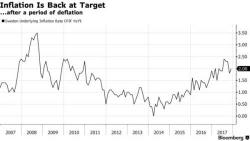

Riksbank Formally Ends QE But Pledges Continued Dovish Support For Bond Market

While the Riksbank left its repo rate unchanged at -0.5%, as expected, in its decision this morning, far more interesting was the Riksbank's decision to formally end making new bond purchases, i.e., QE, after almost three years. However, in order to ensure a smooth transition, the Riksbank said the end of QE would take place in the most dovish way possible and the central bank would continue reinvesting maturing bonds and coupons, and also announced that it will bring forward some of the large 2019 redemptions, which it will reinvet in 2018.