Global Shares Hit Another Record High In Lethargic Session Ahead Of US Data Deluge

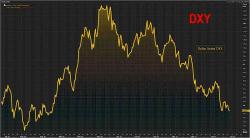

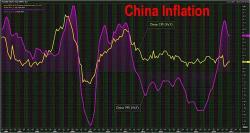

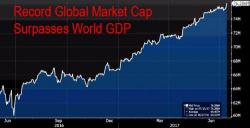

It was another painfully low-volume overnight session, which however did not prevent global stocks from hitting another record highs, capping their best week in over two months as the dollar stayed close to nine-month lows following Yellen's dovish retreat in which she noted caution on persistently low inflation (hence today's CPI print will be especially important) as odds of future rate hikes in 2017 and 2018 dropped.