What Wall Street Expects From Today's Payrolls Report And How To Trade It

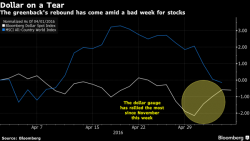

In what may be one of the least relevant payroll reports in a long time as the Fed already knows the labor market is doing better quantiatively (qualitatively it has been all about low-paying jobs gaining at the expense of higher paying manufacturing and info-tech positions) and as has further demonstrated it is no longer jobs data dependent, here is what Wall Street consensus expects: total payrolls +200,000, down from 215K in March; a 4.9% unemployment rate; average hourly earnings rising 0.3% (last 0.3%) M/M and 2.4% Y/Y (last 2.3%); on labor force participation