A Desperate China Begged Fed For "Plunge Protection Playbook" As Its Market Crashed

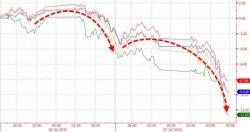

Last June, China’s stock market miracle ended in tears.

The SHCOMP’s inexorable, parabolic ascent was to a large degree facilitated by an explosion of margin debt, the likes of which could not be found in any other major market across the globe. For instance, by the end of June, the outstanding balance of margin transactions as a percentage of the SHCOMP’s free float market cap was nearly 14% compared to just 5.5% for the S&P and less than 1% for the TOPIX.