Sticker Shock: Fed to Hike Rates First Time in NINE Years!

Sticker Shock: Fed to Hike Rates First Time in NINE Years!

Sticker Shock: Fed to Hike Rates First Time in NINE Years!

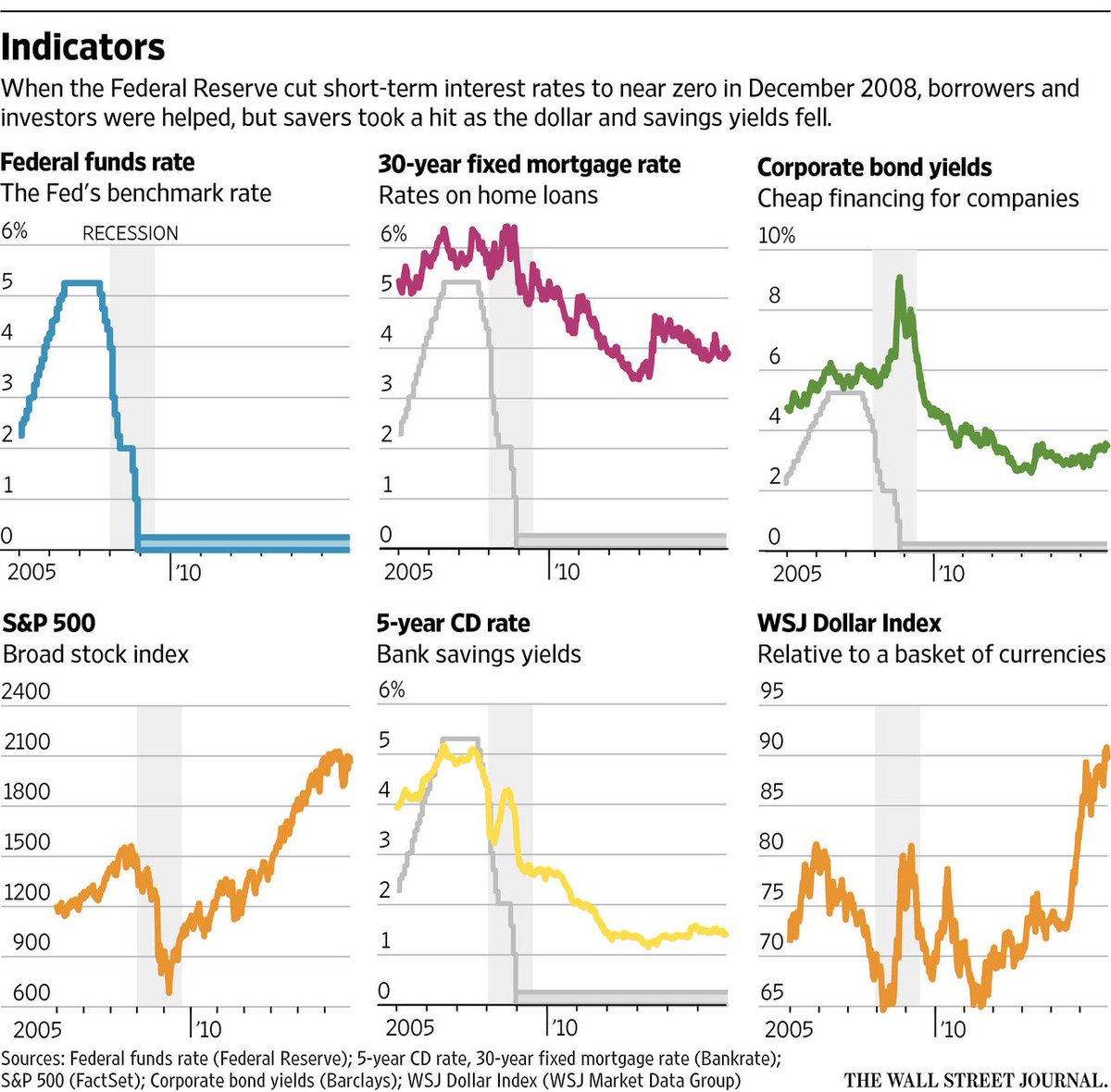

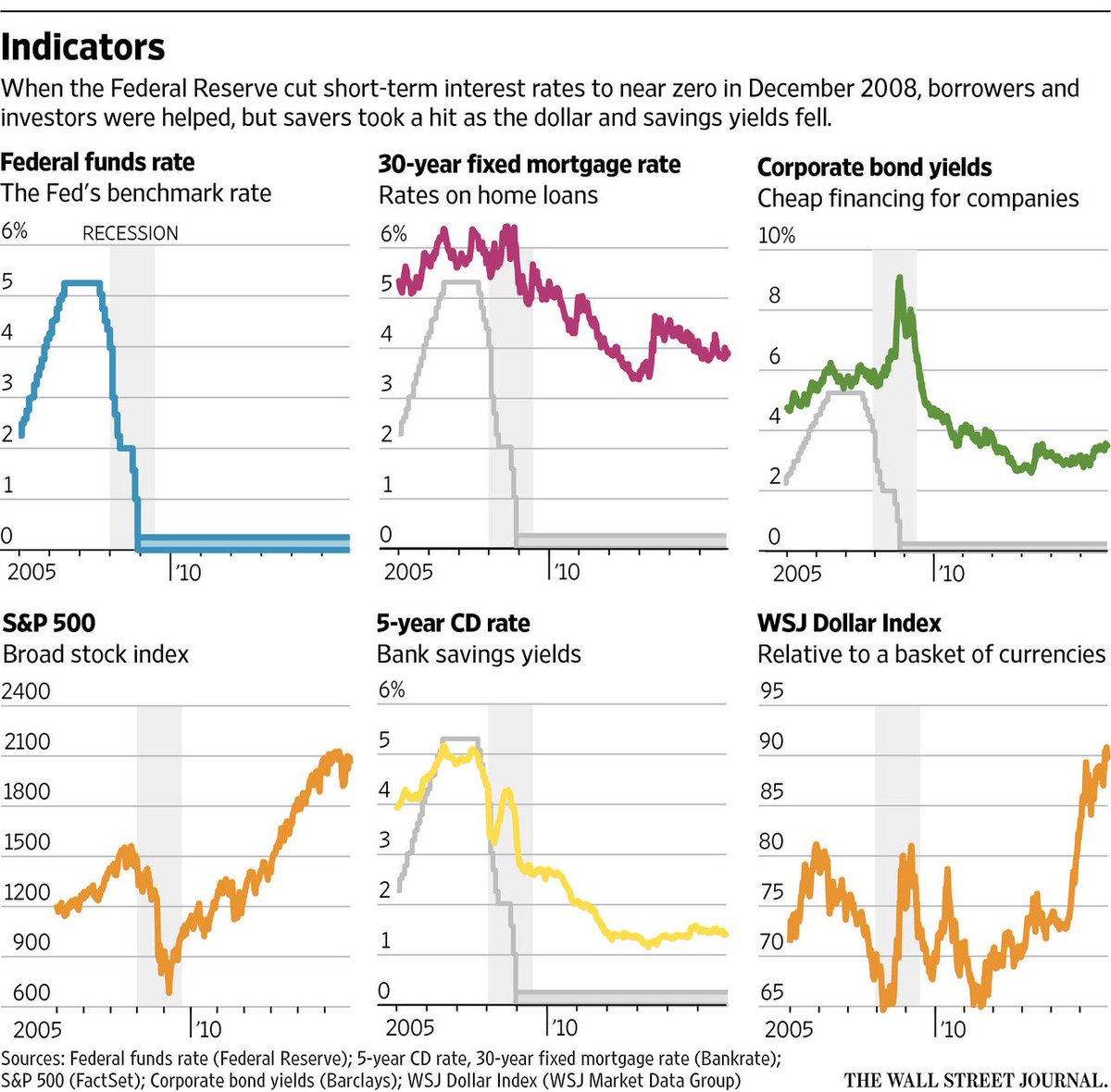

Courtesy of Phil’s Stock World

A rate hike – what’s that?

Sticker Shock: Fed to Hike Rates First Time in NINE Years!

Sticker Shock: Fed to Hike Rates First Time in NINE Years!

Courtesy of Phil’s Stock World

A rate hike – what’s that?