Global Stocks, Futures Continue Surge On Lingering Rate Hike Euphoria

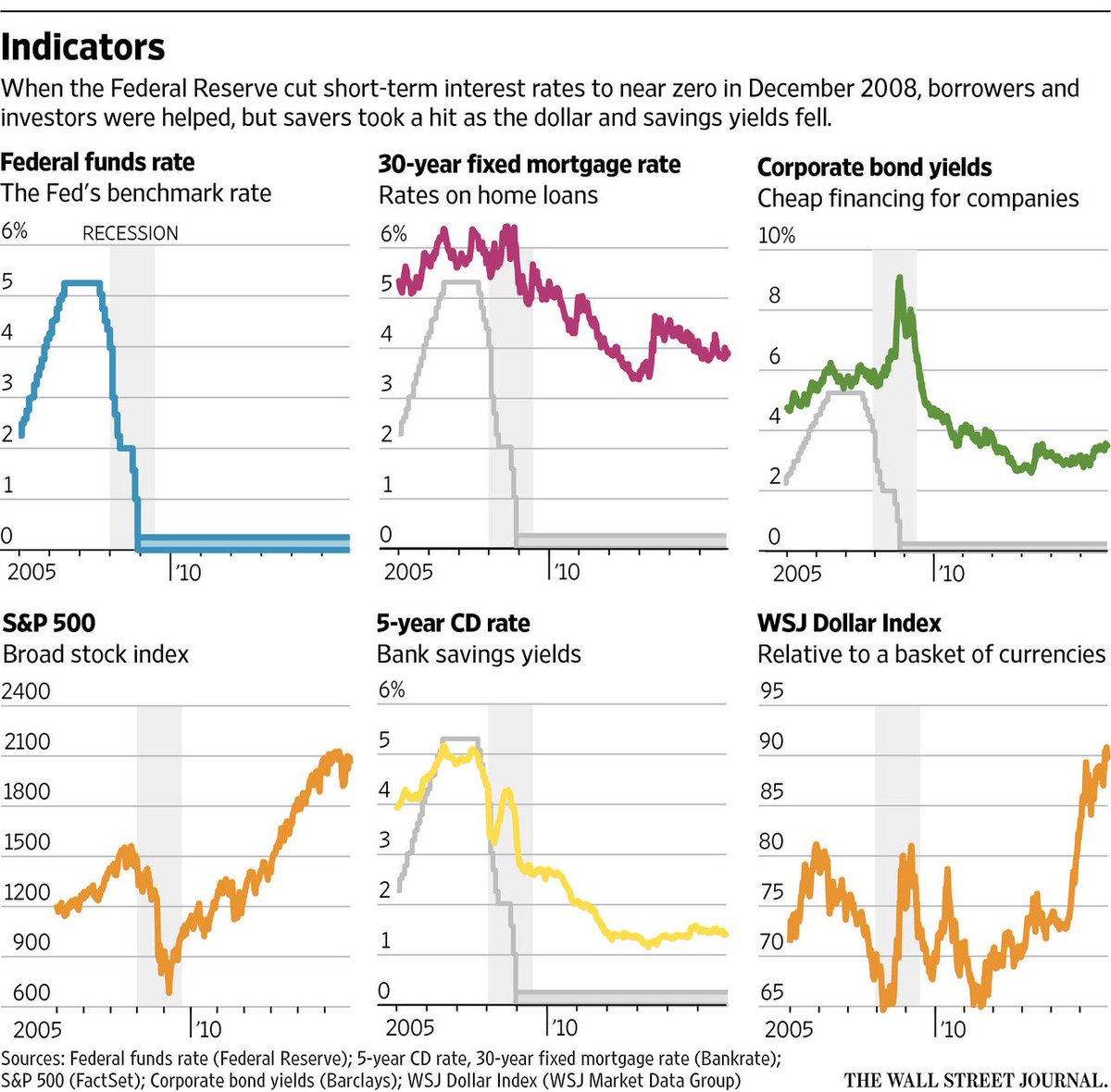

Heading into the Fed's first "dovish" rate hike in nearly a decade, the consensus was two-fold: as a result of relentless telegraphing of the Fed's intentions, the hike is priced in, and it will be a "dovish" hike, with the Fed lowering its forecast for the number of hikes over the next year.

Sticker Shock: Fed to Hike Rates First Time in NINE Years!

Sticker Shock: Fed to Hike Rates First Time in NINE Years!