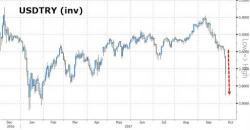

Turkish Lira Crashes 4%, Biggest Drop Since "Failed Coup" Following Visa Suspension Drama

With tensions between Turkey and the US escalating dramatically and unexpectedly in the past few days, when first Turkish police on Wednesday arrested a local employee of the US embassy in Istanbul and charged him with espionage and an attempt to overthrow the government, which was following on Sunday afternoon by the US embassy in Turkey announcing that "effective immediately" it has "suspended all non-immigrant visa services at all U.S. diplomatic facilities in Turkey"...