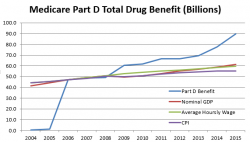

Why Some Pharmaceuticals Are So Expensive

Authored by Gilbert Berdine via The Mises Institute,

Enter “outrageous drug prices” into Google and you will receive plenty of examples. As reported here, Marathon Pharmaceuticals planned to charge $89,000 per year for its Emflaza brand of the corticosteroid deflazacort. Deflazacort was introduced in 1969 and is available outside the U.S. for less than $2 per tablet. US patients with muscular dystrophy have been obtaining the drug for around $1,500 per year from foreign sources.