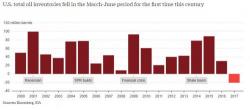

What Oil Bulls Are Missing: "The Oil Is Just Being Moved Elsewhere"

Dispensing his usual dose of optimistic crude oil buzzkill, Bloomberg energy strategist Julian Lee points out something troubling to both OPEC, and those who are hoping that the latest dip in oil will finally lead to a sharp rally. He writes that while at first glance, this year’s diminishing U.S. oil stockpiles appear to support the notion OPEC is finally getting the global crude glut under control. Surging exports mean that the market should treat that idea with caution.