James Clapper And The Revolving Door Of Corruption In The Military Industrial Complex

Via Disobedient Media

James Clapper is known for many things:

Via Disobedient Media

James Clapper is known for many things:

As one would expect, last week's report by Bank of America's Benjamin Bowler, in which the strategist stated that "these markets are very weird"...

... and in which Bank of America warned that "US equities continue to set long-term records for instability", prompted many questions from traders and investors.

Authored by Thorstein Polleit via The Mises Institute,

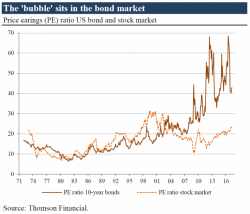

The US bond market trades at a quite high valuation. For instance, the 10-year US Treasury bond presents a price earnings (PE) ratio of 43. In other words: It takes 43 years for the investor to recoup the bond’s purchase price through coupon payments; the bond market’s PE ratio even went up to 68 in June 2012 and July 2016, respectively.

It has been another quiet session for global equity markets, with S&P futures flat, as are European and Asian stocks, which is perhaps odd, as there was quite a bit of newsflow and, in the case of China, outright fireworks.

The US dollar will almost certainly remain the world's most important reserve currency for the foreseeable future but the lack of a ready substitute does not mean the dollar's current position is entirely assured, says Fitch Ratings in its latest Global Perspectives commentary.