James Jaeger: New Documentary “Mainstream” on The Globalist Agenda in Movies

Via The Daily Bell

Via The Daily Bell

As one would expect, in a week that saw the biggest one-day drop in US equities since last September, retail investors bailed on US stocks resulting in what BofA dubbed "risk-off flows" as $1.6 billion was pulled from global equities - with active managers once again getting the short end of the stick, with $4.3 billion in outflows from mutual funds, largest in 7 weeks while another $2.7 billion flowed into ETFs - offset by $9.7 billion inflows to bonds and $0.2 billion to gold.

Authored by Zainab Calcuttawala via OilPrice.com,

It’s “Infrastructure Week” in Washington, and foreign powers are taking note.

Ahead of President Donald Trump’s upcoming visit to the Middle East, Saudi Arabia has promised to make $40 billion of its sovereign wealth fund available to the United States to bankroll part of the roughly $1 trillion in infrastructure improvements that Trump promised on the campaign trail.

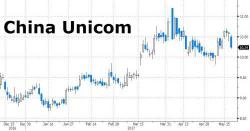

Fabricating data in China, it turns out, is not only a favorite government pastime. Publicly traded, if state-owned, phone giant Unicom Group fabricated financials relating to 1.8 billion yuan ($261 billion) in revenue over a five-year period from 2012 to 2016 - or as the company admitted, it engaged in an "unprecedented degree of falsified revenue." This is China we are talking about, where the definition of "unprecedented" is very different from the US.

In the second incident between US and Chinese planes this year, two Chinese Su-30 fighter jets came within 150 feet of a U.S. Air Force WC-135 radiation detection plane while it was flying over the Yellow Sea in international airspace on Wednesday, CNN reports, citing an unidentified U.S. official.

The Chinese jets came within 150 feet of the US plane, with one of the Su-30s flying inverted, or upside down, directly above the American plane, the official said.