A Delighted Wall Street Reacts To The French Election

With European stocks on fire, and US futures moving fast to recoup recent all time highs, it is no surprise that Wall Street is feeling particularly bullish this morning.

With European stocks on fire, and US futures moving fast to recoup recent all time highs, it is no surprise that Wall Street is feeling particularly bullish this morning.

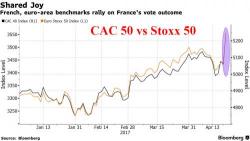

Risk is definitely on this morning as European shares soar, led by French stocks and a new record high in Germany's Dax, after a "French relief rally" in which the first round of the country’s presidential elections prompted investors to bet that establishment candidate Emmanuel Macron will win a runoff vote next month, and who is seen as a 61% to 39% favorite to defeat Le Pen according to the latest just released Opinionway poll.

For those who may have missed yesterday's events, here is a quick recap from DB:

Wall Street still exudes widespread optimism that 2017 will provide another year of solid gains for stocks amid stable albeit unspectacular economic growth and only gentle interest rate rises. However, as The FT details, all is not well in reality, and the following seven charts will hearten investors of a more bearish persuasion...

A third US citizen has been arrested and remains in custody in North Korea, according to South Korean news agency Yonhap. A man, a Korean-American professor in his 50s, identified by the surname Kim, had been in North Korea for a month to discuss relief activities and was detained at Pyongyang International Airport just as he was leaving North Korea, the agency reported.

Via StockBoardAsset.com,