The United States Stands Before The World As A Criminal Nation

The United States Stands Before The World As A Criminal Nation

The United States Stands Before The World As A Criminal Nation

Authored by Charles Hugh-Smith via OfTwoMinds blog,

Trying to reduce the carefully choreographed drama to one stage and one audience risks misunderstanding the signal.

It seems many media observers are confused by events in Syria and the swirl of competing narratives. Did the Swamp drain Trump? Did the Neocons succeed in forcing Trump to follow their lead? Is the U.S. ramping up yet another endless war?

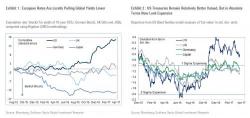

Roughly at the same time as today's French election narrative shifted again as traders started paying attention to the suddenly surging in the polls far-left candidate Jean-Luc Melenchon, which pushed the Euro to the lowest level in a month, Goldman has come out with a recommendation to short June OAT futures (OATM7) at 147-72, for an initial target of 144.00, and stops on a close above 150.00,

In this holiday-shortened week (markets closed for Good Friday), focus turns to several inflation prints in G10 in the week ahead, with US and UK inflation data likely to get the most attention. In addition, there are a few scheduled speaking engagements by Fed officials, including a speech by Fed Chair Yellen on Monday.

While the US ambassador to the UN, Nikki Haley, and US Secretary of State Rex Tillerson seem unable to agree on what the right policy is regarding Syria and specifically Assad, with the former saying a top priority of Trump is to oust Assad, while the latter claimed over the weekend that the Islamic State is the key concern while Assad's fate and that the people of Syria should decide Assad's fate, Russia is not waiting for clarification.