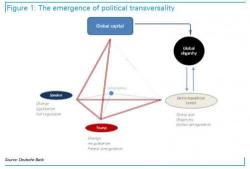

From "Dissensus" To "Democrazy": A Warning From Deutsche Bank

Last October, Deutsche Bank's credit derivatives expert Aleksandar Kocic, one of the best stream-of-consciousness, James Joyceian writers among the Wall Street sell-side, penned what was at the time the best summary why the existing politcal system was fracturing with every passing day.