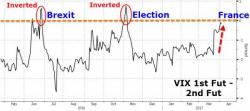

Global Stocks Rebound From Overnight Lows, On Edge Ahead Of Trump-Xi Meeting

S&P futures are little changed at 6am ET, trading at 2347.55 and paring an earlier 0.4 percent drop, on the back of the USDJPY ramp which for the second day in a row has emerged alongside the European open, just as the key 110 support level appears in danger, soothing concerns about the Fed's balance sheet reduction and "some" Fed officials warning that stocks have gotten expensive.