How Corporate Media Continues To Use The 'Russia Scapegoat' To Distract from Status Quo Failure

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

Submitted by Mike Krieger via Liberty Blitzkrieg blog,

Submitted by Nick Cunningham via OilPrice.com,

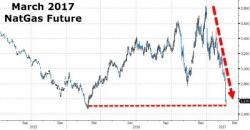

Natural gas prices plunged to their lowest level since November on mild weather in the U.S., which has caused storage levels to decline at a much slower pace than expected.

Contracts for March delivery on the Nymex exchange dipped to $2.63 on February 21, down a third since December. The bearish swing has come after successive EIA reports showing a modest drawdown in gas inventory levels.

How important are immigrants to the U.S. housing market? At least according to University of Washington economist Jacob Vigdor they could own roughly 12.5% of the housing stock in the U.S. worth about $3.7 trillion in aggregate.

This past Saturday, two weeks after the White House unveiled new sanctions on two dozen Iranian entities in retaliation for a recent ballistic missile test, Iran's elite Revolutionary Guard announced it was set to conduct military drills this week despite warnings from the United States not to engage in such activity. General Mohammad Pakpour, commander of the force's ground units, told a news conference that "the manoeuvres called 'Grand Prophet 11' will start Monday and last three days." and warned that "rockets would be used" without specifying which kind.

In China's latest test of the US response to its escalating claims of islands in the South China Sea, Reuters reports that Beijing has "nearly finished building almost two dozen structures on artificial islands in the South China Sea that appear designed to house long-range surface-to-air missiles." Predictably, such a development will likely raise questions about whether and how the United States will respond, given its vows to take a tough line on China in the South China Sea. The structures appear to be 20 meters (66 feet) long and 10 meters (33 feet) high.