Abolish Corporations

The Daily Bell Abolish Corporations

The Daily Bell Abolish Corporations

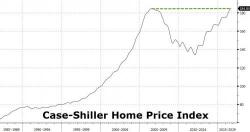

Almost exactly ten years after the last housing bubble burst, unleashing a dramatic crash in US real estate prices - something Ben Bernanke had said in the mid-2000's would be unprecedented - today Case Shiller reported that as of September, its Index covering all nine U.S. census divisions, surpassed the peak set in July 2006 as the housing boom topped out, and in doing so the average home price has now climbed back above the record reached more than a decade ago, bringing to a close the worst period for the housing market since the Great Depression.

In a choice that confirms Trump's intentions to dismantle Obamacare, Reuters reports that President-elect Donald Trump will shortly announce he has chosen vociferous Obamacare critic Tom Price (R. Ga), an orthopedic surgeon from Georgia, as his Health and Human Services secretary to help him overhaul the U.S. healthcare system.

Chairman of the House Budget Committee Tom Price

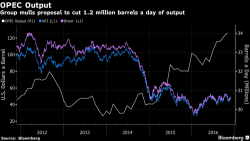

European stocks were little changed and oil fell as investors assessed declining prospects for an OPEC deal and risks from Italy’s referendum. Asian stocks declined, while S&P futures pointed to a fractionally higher open, erasing 3 points from yesterday's drop.

Trader attention today - and tomorrow - will be focused on oil which retreated back under $47 as OPEC members failed to bridge differences on production cuts, while a rally in metals ran out of steam. The rand plunged after President Jacob Zuma survived a leadership threat.

Conduit CMBS (Commercial Mortgage Backed Security) debt outstanding is down from $740 billion in 2007 to $400 billion currently according a recent note from Goldman Sachs. The Non-Agency RMBS (Residential Mortgage Backed Security) Market, not backed by the US Government, has been contracting at a rate of 10 percent year, mostly due to prepayments and studious lenders paying off their loans. Agency RMBS (loans backed by the US Government) have been steadily climbing, reaching a level of $200 billion in issuance for the trailing 12 months.