Algorithmic Trading is the Investment of the Future

From Fortress Capital:

From Fortress Capital:

As SHTFPLan.com's Mac Slavo notes...

While the powers that be are determining the fate of alternative media voices that are now branded under the dubious label “fake news” and blacked out from online search results, it is worth keeping in mind all the disinformation and downright lies that have been perpetrated by the corporate news media – typically hand in hand with a political agenda.

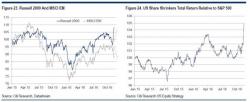

Donald Trump’s election victory has driven significant rotation across global markets. Bond yields are up, the USD has strengthened, DM equities have risen, EM equities have fallen and cyclical stocks have outperformed defensives. Amid the chaos, Citi's Global Equity Strategy team has attempted to craft some "Trump Trades" to help investors take advantage of the volatility.

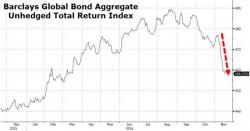

With US Treasuries the most oversold since 2007, Bloomberg reports that bonds around the world are headed for their steepest two-week loss in at least 26 years as President-elect Donald Trump sends inflation expectations surging.

The Bloomberg Barclays Global Aggregate Index has fallen 4 percent in the period through Thursday.

The US oil rig count surged by 19 to 471 last week - the biggest weekly rise since July 2015 back to 9-month highs. This is the 22nd weekly rise in the last 24 weeks and is occurring as US crude production is beginning to rise once again.

Tracking lagged WTI prices still...

And US production is on the rise...

WTI prices slipped on the print...