People Are Finally Worried About People Being Worried

Submitted by Joseph Calhoun via Alhambra Investment Partners,

Submitted by Joseph Calhoun via Alhambra Investment Partners,

While this may well be the most important week for capital markets in the past 9 years, when the Fed is widely expected to hike rates on Wednesday, precisely 7 years to the day since it cut rates to zero, the week sets off with a quiet start today with just the Euro area industrial production reading due out this morning and nothing expected out of the US this afternoon.

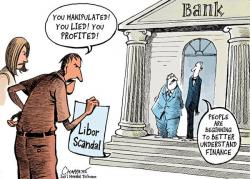

Hold your real assets outside of the banking system in a private international facility --> http://www.321gold.com/info/053015_sprott.html

Fractional-Reserve Banking is Pure Fraud, Part IV

Written by Jeff Nielson (CLICK FOR ORIGINAL)

Authored by Mark St.Cyr,

Submitted by Peter Schiff via Euro Pacific Capital,