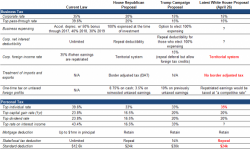

Still Confused About Trump's 1-Page Tax Plan? Goldman Explains It All

Since at its core, yesterday's 1-page "tax plan" was a Goldman creation - and was presented to the world by two former Goldman employees - who better to explain what Trump had in mind than Goldman Sachs itself, which it did overnight in a far lengthier note from its chief Washington analyst Alec Phillips.