Published

13 seconds ago

on

November 30, 2023

| 13 views

-->

By

Jenna Ross

The following content is sponsored by New York Life Investments

3 Reasons Why AI Enthusiasm Differs from the Dot-Com Bubble

Artificial intelligence, like the internet during the dot-com bubble, is getting a lot of attention these days. In the second quarter of 2023, 177 S&P 500 companies mentioned “AI” during their earnings call, nearly triple the five-year average.

Not only that, companies that mentioned “AI” saw their stock price rise 13.3% from December 2022 to September 2023, compared to 1.5% for those that didn’t.

In this graphic from New York Life Investments, we look at current market conditions to find out if AI could be the next dot-com bubble.

Comparing the Dot-Com Bubble to Today

In the late 1990s, frenzied optimism for internet-related stocks led to a rapid rise in valuations and an eventual market crash in the early 2000s. By the time the market hit rock bottom, the tech-heavy Nasdaq 100 Index had dropped 82% from its peak.

The growing enthusiasm for AI has some concerned that it could be the next dot-com bubble. But here are three reasons that the current environment is different.

1. Valuations Are Lower

Stock valuations are much lower than they were at the peak of the dot-com bubble. For example, the forward price-to-earnings ratio of the Nasdaq 100 is significantly lower than it was in 2000.

| Date | Forward P/E Ratio |

|---|---|

| March 2000 | 60.1x |

| November 2023 | 26.4x |

Source: CNBC, Barron’s

Lower valuations are an indication that investors are putting more emphasis on earnings and stocks are less at risk of being overvalued.

2. Investors Are More Hesitant

During the dot-com bubble, flows to equity funds increased by 76% from 1999 to 2000.

| Year | Combined ETF and Mutual Fund Flows to Equity Funds |

|---|---|

| 1997 | $231B |

| 1998 | $163B |

| 1999 | $200B |

| 2000 | $352B |

| 2001 | $63B |

| 2002 | $14B |

Source: Investment Company Institute

In contrast, equity fund flows have been negative in 2022 and 2023.

| Year | Combined ETF and Mutual Fund Flows to Equity Funds |

|---|---|

| 2021 | $295B |

| 2022 | -$54B |

| 2023* | -$137B |

Source: Investment Company Institute*2023 data is from January to September.

Based on fund flows, investors appear hesitant of stocks, rather than overly exuberant.

3. Companies Are More Established

Leading up to the internet bubble, the number of technology IPOs increased substantially.

| Year | Number of Technology IPOs | Median Age |

|---|---|---|

| 1997 | 174 | 8 |

| 1998 | 113 | 7 |

| 1999 | 370 | 4 |

| 2000 | 261 | 5 |

| 2001 | 24 | 9 |

| 2002 | 20 | 9 |

Source: Ritter, Jay R. University of Florida

Many of these companies were relatively new and, at the peak of the bubble in 2000, only 14% of them were profitable.

In recent years, there have been far fewer tech IPOs as companies wait for more positive market conditions. And those that have gone public, the median age is much higher.

| Year | Number of Technology IPOs | Median Age |

|---|---|---|

| 2020 | 48 | 12 |

| 2021 | 126 | 12 |

| 2022 | 6 | 15 |

Source: Ritter, Jay R. University of Florida

Ultimately, many of the companies benefitting from AI are established companies that are already publicly traded. New, unproven companies are much less common in public markets.

Navigating Modern Tech Amid Dot-Com Bubble Worries

Valuations, equity flows, and the shortage of tech IPOs all suggest that AI isn’t shaping up to be the next dot-com bubble.

However, risk is still present in the market. For instance, only 33% of tech companies that went public in 2022 were profitable. Investors can help manage their risk by keeping a diversified portfolio rather than choosing individual stocks.

Explore more insights from New York Life Investments.

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #ai #artificial intelligence #dot-com bubble #fund flows #New York Life Investments #NYLI #tech ipos #valuation

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "3 Reasons Why AI Enthusiasm Differs from the Dot-Com Bubble";

var disqus_url = "https://www.visualcapitalist.com/sp/3-reasons-why-ai-enthusiasm-differs-from-the-dot-com-bubble/";

var disqus_identifier = "visualcapitalist.disqus.com-162669";

You may also like

-

Markets1 day ago

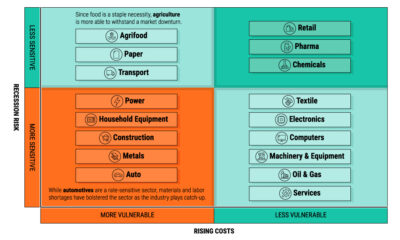

Recession Risk: Which Sectors are Least Vulnerable?

We show the sectors with the lowest exposure to recession risk—and the factors that drive their performance.

-

GDP2 days ago

Visualizing U.S. GDP by Industry in 2023

Services-producing industries account for the majority of U.S. GDP in 2023, followed by other private industries and the government.

-

Markets2 days ago

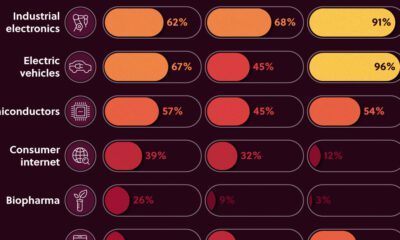

Charted: The Industries Where Asian Companies are the Strongest

We look at the share of Asian companies in the top 3,000 global firms—measured by market capitalization in 2020—broken down by industry.

-

Globalization6 days ago

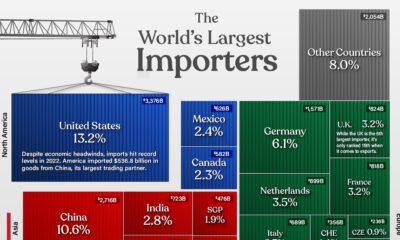

The Top 50 Largest Importers in the World

The value of global imports hit $25.6 trillion in 2022. Here are the world’s largest import countries, and their share of the global total.

-

Markets7 days ago

Ranked: The Biggest Retailers in the U.S. by Revenue

From Best Buy to Costco: we list out the biggest retailers in the U.S., and how much they earned from their stores in 2022.

-

Markets7 days ago

Visualizing 30 Years of Imports from U.S. Trading Partners

Nearly 60% of U.S. imports came from just four trade entities in 2023. We rank the top U.S. trading partners and show their growth over time.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post 3 Reasons Why AI Enthusiasm Differs from the Dot-Com Bubble appeared first on Visual Capitalist.