![]()

See this visualization first on the Voronoi app.

Use This Visualization

Charted: The Decline of U.S. Housing Affordability (1967–2023)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

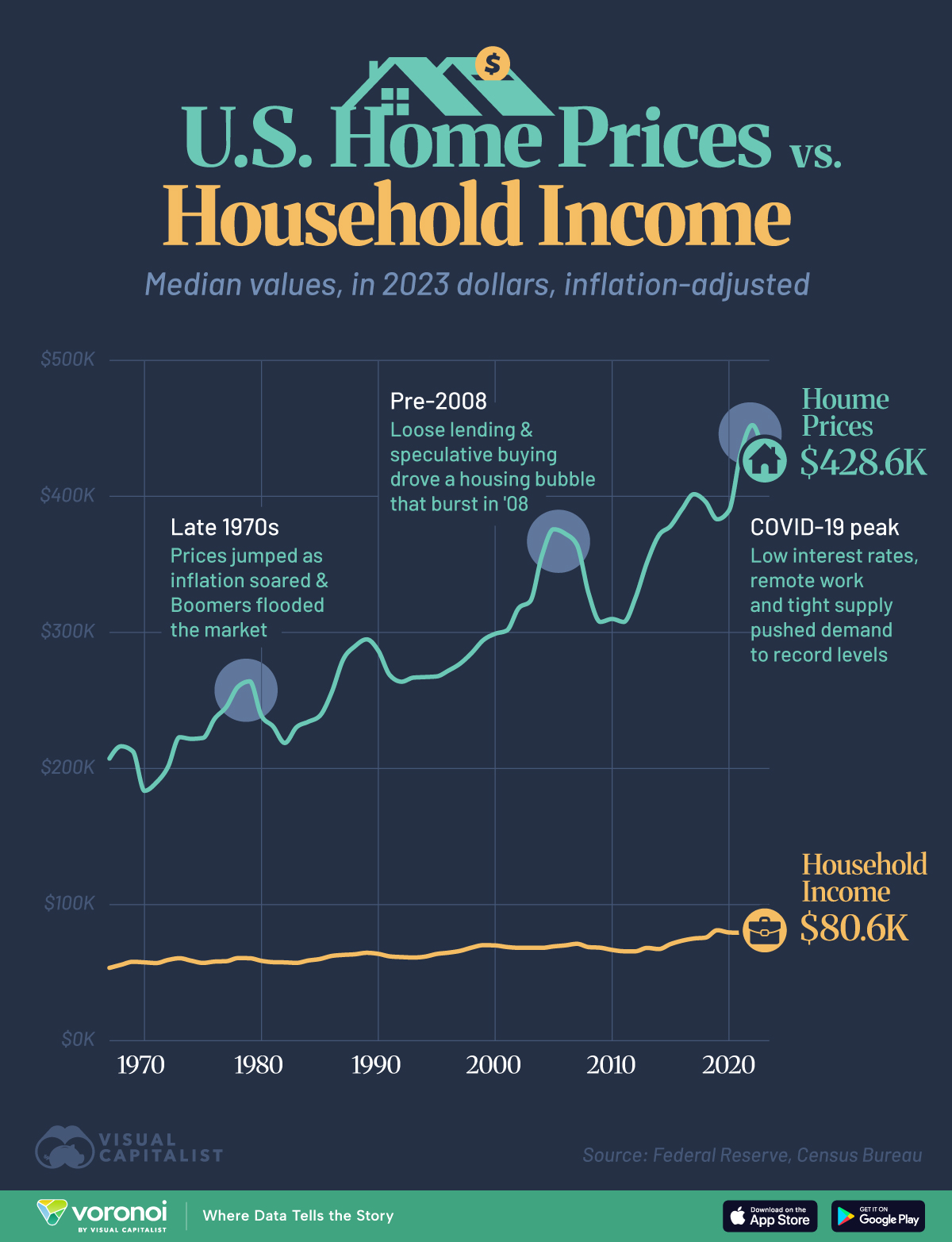

- Housing affordability has worsened considerably since the 1970s as prices rise faster than incomes.

- The median sales price of a new U.S. home reached $428,600 in 2023.

- That price was more than five times the median household income of $80,610.

The cost of a typical American home has raced far ahead of paychecks.

This graphic (and below video) charts how the median sales price of a newly-built privately-owned residential units (including houses and apartments) and the median household income have moved since 1967.

Data for this graphic is sourced from the Census Bureau (both home prices and household incomes).

The Federal Reserve’s CPI-U index was used to convert both to 2023 dollars for an apples-to-apples comparison.

Tracking U.S. Home Prices vs. Household Incomes

The median sales price of a new U.S. home reached $428,600 in 2023. That price was more than five times the median household income of $80,610 that year.

See how both metrics have moved since 1967 in the video below.

The widening gap underscores why today’s buyers feel squeezed, even with low-down-payment loans and longer mortgage terms.

It also hints at deeper forces, from land-use rules to interest-rate cycles, shaping the housing market’s boom-and-bust rhythm.

The Affordability Ratio Has Doubled Since 1970

Dividing price by income yields a home-price ratio, a quick gauge of affordability. A ratio of 3 is often cited as a sustainable benchmark.

Back in 1970, the typical new home cost just 3.2 times the median income.

| Year | Median Household Income (2023 Dollars) |

Median Home Prices (2023 Dollars) |

Home-Price Ratio |

|---|---|---|---|

| 1967 | $53,530 | $207,346 | 3.87 |

| 1968 | $55,810 | $216,372 | 3.88 |

| 1969 | $58,010 | $212,640 | 3.67 |

| 1970 | $57,580 | $183,645 | 3.19 |

| 1971 | $57,090 | $189,631 | 3.32 |

| 1972 | $59,330 | $201,110 | 3.39 |

| 1973 | $60,610 | $223,036 | 3.68 |

| 1974 | $58,780 | $221,845 | 3.77 |

| 1975 | $57,180 | $222,510 | 3.89 |

| 1976 | $58,160 | $236,658 | 4.07 |

| 1977 | $58,450 | $245,337 | 4.20 |

| 1978 | $60,720 | $260,172 | 4.28 |

| 1979 | $60,610 | $264,082 | 4.36 |

| 1980 | $58,720 | $238,856 | 4.07 |

| 1981 | $57,730 | $230,893 | 4.00 |

| 1982 | $57,570 | $218,817 | 3.80 |

| 1983 | $57,210 | $230,362 | 4.03 |

| 1984 | $58,930 | $234,356 | 3.98 |

| 1985 | $60,050 | $238,795 | 3.98 |

| 1986 | $62,280 | $255,752 | 4.11 |

| 1987 | $63,060 | $280,232 | 4.44 |

| 1988 | $63,530 | $289,865 | 4.56 |

| 1989 | $64,610 | $294,952 | 4.57 |

| 1990 | $63,830 | $286,609 | 4.49 |

| 1991 | $61,960 | $268,476 | 4.33 |

| 1992 | $61,450 | $263,841 | 4.29 |

| 1993 | $61,150 | $266,823 | 4.36 |

| 1994 | $61,800 | $267,237 | 4.32 |

| 1995 | $63,770 | $267,743 | 4.20 |

| 1996 | $64,710 | $271,968 | 4.20 |

| 1997 | $66,050 | $277,145 | 4.20 |

| 1998 | $68,470 | $285,059 | 4.16 |

| 1999 | $70,210 | $294,504 | 4.19 |

| 2000 | $70,020 | $299,039 | 4.27 |

| 2001 | $68,870 | $301,489 | 4.38 |

| 2002 | $68,310 | $317,787 | 4.65 |

| 2003 | $68,350 | $322,991 | 4.73 |

| 2004 | $68,250 | $356,511 | 5.22 |

| 2005 | $69,310 | $375,861 | 5.42 |

| 2006 | $70,080 | $372,580 | 5.32 |

| 2007 | $71,210 | $364,303 | 5.12 |

| 2008 | $68,780 | $328,474 | 4.78 |

| 2009 | $68,340 | $307,774 | 4.50 |

| 2010 | $66,730 | $309,934 | 4.64 |

| 2011 | $65,750 | $307,764 | 4.68 |

| 2012 | $65,740 | $325,413 | 4.95 |

| 2013 | $68,220 | $351,714 | 5.16 |

| 2014 | $67,360 | $371,326 | 5.51 |

| 2015 | $71,000 | $378,214 | 5.33 |

| 2016 | $73,520 | $390,768 | 5.32 |

| 2017 | $75,100 | $401,637 | 5.35 |

| 2018 | $75,790 | $396,065 | 5.23 |

| 2019 | $81,210 | $383,175 | 4.72 |

| 2020 | $79,560 | $389,573 | 4.90 |

| 2021 | $79,260 | $431,240 | 5.44 |

| 2022 | $77,540 | $452,385 | 5.83 |

| 2023 | $80,610 | $428,600 | 5.32 |

By 2004, that ratio had breached 5x for the first time, and it has rarely dipped below 5 since the Great Financial Crisis. In 2022, the ratio peaked at 5.83—an all-time high.

Even with a slight pullback in 2023, the multiple remains about two times higher than it was half a century ago, signaling persistent affordability pressure.

Boom-and-Bust Cycles Leave Lasting Scars

The 2000-2006 housing boom pushed home prices up faster than incomes, inflating the ratio from 4.3 to 5.4 in just six years.

After the 2008 crash, prices corrected, trimming the multiple to 4.5 by 2009.

Yet incomes stagnated while credit conditions eased, allowing prices to roar back. Each bust resets the market, but the floor keeps rising—suggesting structural supply shortages and demographic demand that quick corrections cannot fully unwind.

Pandemic Stimulus Supercharged Home Prices

Record-low mortgage rates and a surge in remote-work moves propelled home prices in 2020-22. Median new-home prices jumped nearly $63,000 in two years—while median incomes fell slightly.

Even as interest rates climbed in 2023 and prices cooled, the typical buyer still needed more than five years of gross income to purchase a newly built home.

Unless incomes rise faster or supply meaningfully expands, the era of “stretch” affordability looks set to continue.

Learn More on the Voronoi App ![]()

Median values are good for quick understanding but hide variance across the country. For more nuanced data, check out The Income Needed to Buy a Home in Every U.S. State on Voronoi, the new app from Visual Capitalist.