![]()

See this visualization first on the Voronoi app.

Use This Visualization

The Companies Most Exposed to the U.S. Port Strike

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Nearly 50,000 members of the International Longshoremen’s Association (ILA) have walked off the job, putting billions of dollars’ worth of goods at risk of severe delays.

It was estimated that on the first day of the strike (October 1st, 2024), 147 vessels carrying $34.3 billion in goods arrived at 14 idle ports along the East and Gulf coasts of America. The strike comes during peak shipping season, impacting as much as 49% of all U.S. imports.

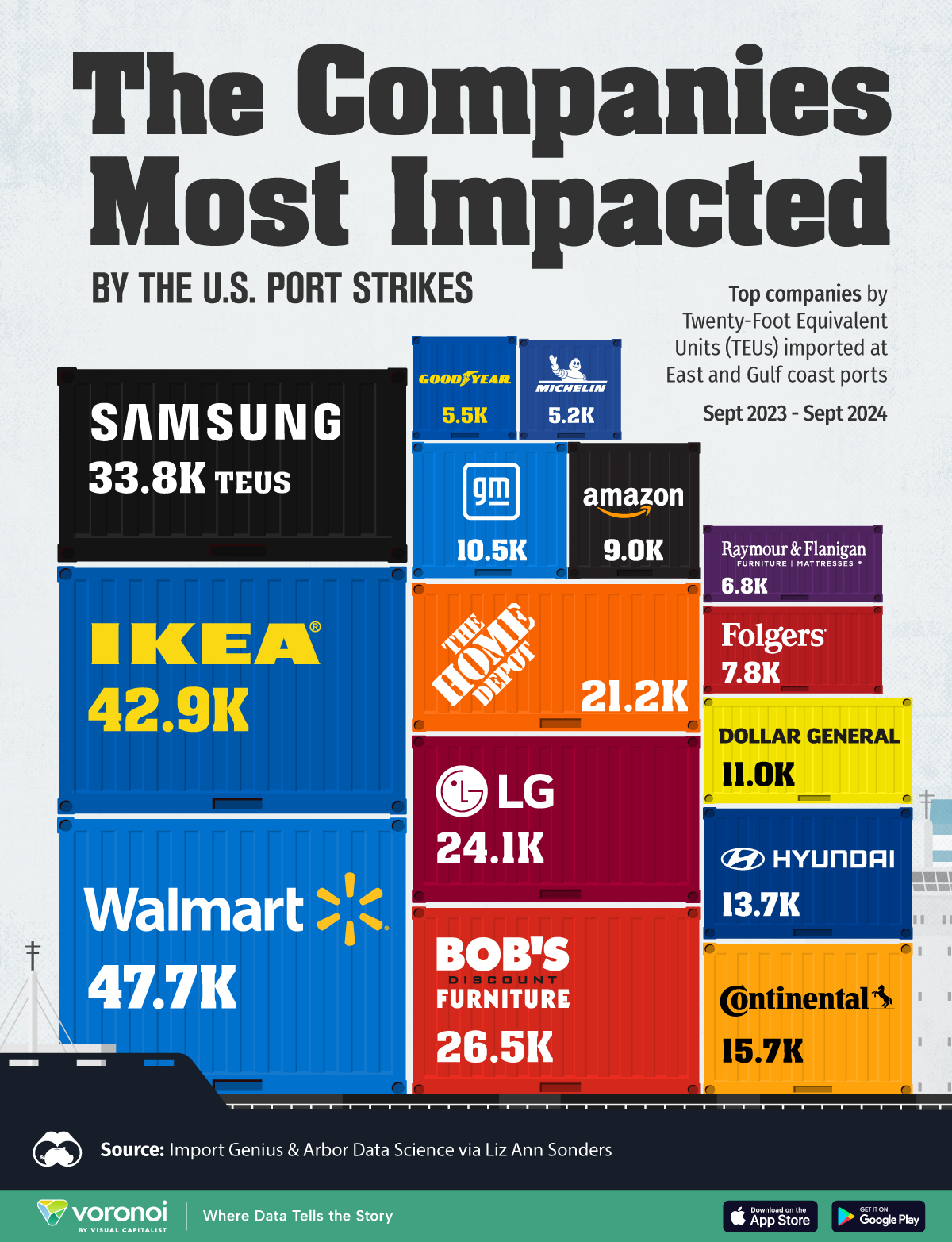

This graphic shows the companies most exposed to the strike—the ones with the most twenty-foot equivalent units (TEUs) imported at East and Gulf coast ports over the past year—based on data from ImportGenius and Arbor Data Science shared by Liz Ann Sonders.

Retail Giants and Tech Firms at Highest Risk from Strike

Below, we show the companies most exposed to the dockworker strike, based on twenty-foot equivalent units (TEUs) imported over the last year:

| Company | TEUs Imported at East and Gulf Coast Ports Sep 2023-Sep 2024 |

|---|---|

| Walmart | 47.7K |

| IKEA | 42.9K |

| Samsung | 33.8K |

| Bob's Discount Furniture | 26.5K |

| LG | 24.1K |

| Home Depot | 21.2K |

| Continental Tire | 15.7K |

| Hyundai | 13.7K |

| Dollar General | 11.0K |

| General Motors | 10.5K |

| Amazon | 9.0K |

| Folgers | 7.8K |

| Raymours Furniture Co | 6.8K |

| Goodyear Tire & Rubber | 5.5K |

| Michelin | 5.2K |

As the most exposed company overall, Walmart announced that it prepared for the strike by having extra inventory in key product categories to mitigate supply chain disruptions.

For context, Walmart, the world’s largest retailer, imported an average of 4,000 TEUs per month through these ports over the past year. The average value of one container can fall around $50,000.

Other major retailers, including IKEA and Home Depot face significant exposure, while tech firms Samsung and LG ranked in the top five highest importers last year.

The auto industry is also highly vulnerable. Hyundai, General Motors, and major tire manufacturers import thousands of containers through these ports annually. A prolonged strike could drive up production costs due to input shortages, however, recent recovery in automaker inventories provides some buffer against immediate supply chain disruptions.

How the U.S. Port Strike is Unfolding

For the first time in five decades, the ILA went on strike after failed negotiations to raise wages by 61.5% over the next six years amid increased automation and record profits for container line companies.

The strike will halt the flow of goods for many companies until an agreement is reached. It also has the potential to impact U.S. exports.

The stoppage could result in an estimated $3.8 to $4.5 billion in losses a day according to analysts, affecting major ports such as New York/New Jersey, Houston, and Baltimore. In particular, the impact on perishable goods will be immediate, with bananas being highly vulnerable. Today, three-quarters of U.S. banana imports pass through the ports affected by the strike.

Learn More on the Voronoi App

To learn more about this topic from a global perspective, check out this graphic on the busiest ports in the world.

The post The Companies Most Exposed to the U.S. Port Strike appeared first on Visual Capitalist.