![]()

See this visualization first on the Voronoi app.

U.S. Announces New Tariffs On A Range of Chinese Goods

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This week, the U.S. introduced a new series of tariff increases on Chinese imports, amounting to over $18 billion worth of goods.

In the announcement, President Biden said they are aiming to “counter China’s unfair trade practices” by targeting specific sectors where the U.S. is boosting domestic production.

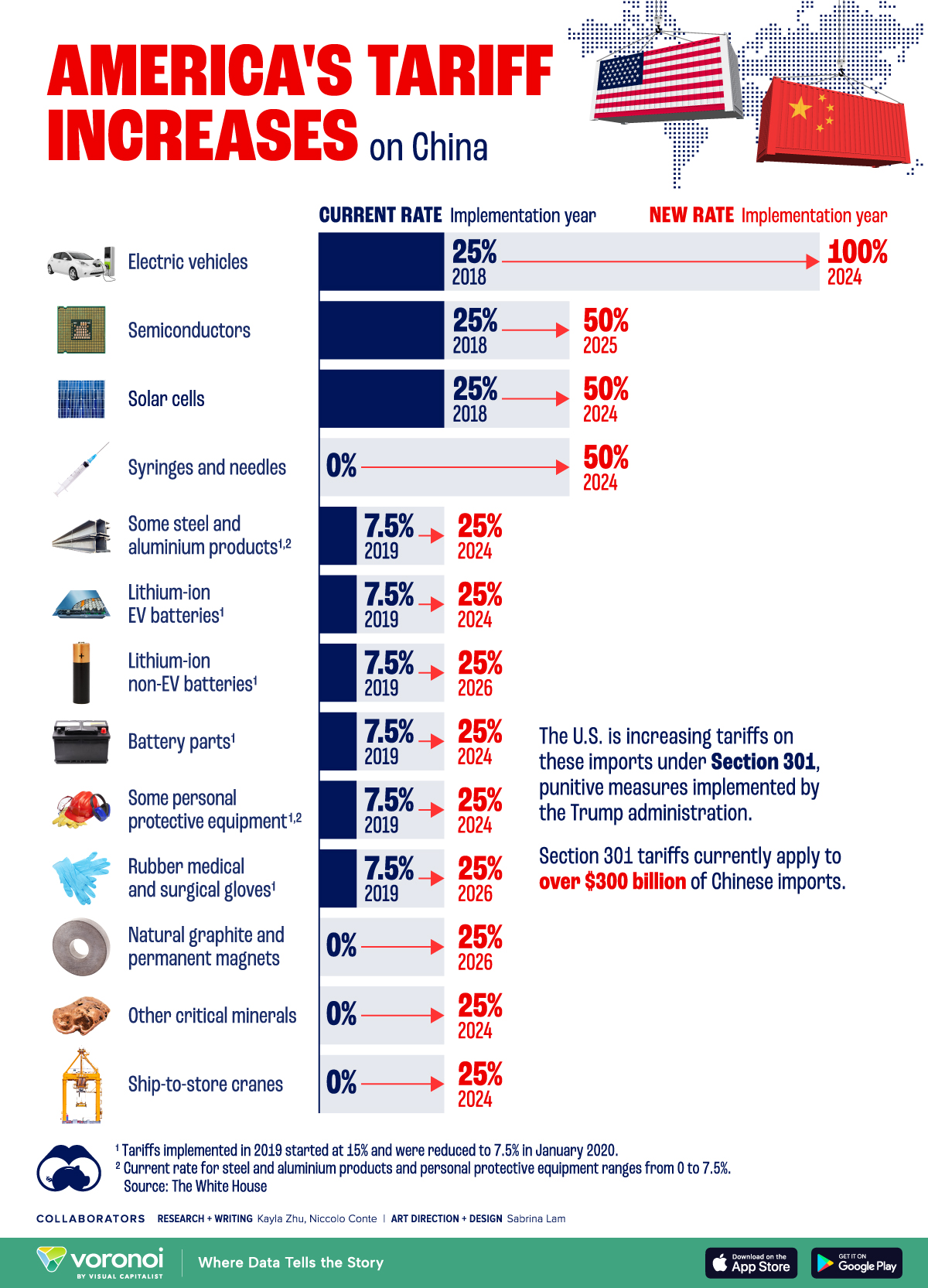

This graphic shows the new and current U.S. tariff rates set on a variety of Chinese imports.

Tariff rates and implementation years for the new rates come from The White House’s May 14 press release announcing the new tariff rate increases. Implementation years for the current rates comes from the Office of the United States Trade Representative (USTR) and United States International Trade Commission (USITC).

Tariff Raises on China Hit EV and Medical Industries

Below, we show the current and new tariff rates, as well as the implementation years for both, for a range of Chinese imports, as of May 14, 2024.

| Import | Current rate | New rate | Implementation year (current rate) | Implementation year (new rate) |

|---|---|---|---|---|

| Electric vehicles (EVs) | 25% | 100% | 2018 | 2024 |

| Semiconductors | 25% | 50% | 2018 | 2025 |

| Solar cells | 25% | 50% | 2018 | 2024 |

| Syringes and needles | 0% | 50% | N/A | 2024 |

| Some steel and aluminium products*† | 7.5% | 25% | 2019 | 2024 |

| Lithium-ion EV batteries | 7.5% | 25% | 2019 | 2024 |

| Lithium-ion non-EV batteries* | 7.5% | 25% | 2019 | 2026 |

| Battery parts* | 7.5% | 25% | 2019 | 2024 |

| Some personal protective equipment (PPE)*† | 7.5% | 25% | 2019 | 2024 |

| Rubber medical and surgical gloves* | 7.5% | 25% | 2019 | 2026 |

| Natural graphite and permanent magnets | 0% | 25% | N/A | 2026 |

| Other critical minerals | 0% | 25% | N/A | 2024 |

| Ship-to-store cranes | 0% | 25% | N/A | 2024 |

†Current rate for steel and aluminium products and personal protective equipment ranges from 0 to 7.5%.

*Tariffs implemented in 2019 started at 15% and were reduced to 7.5% in January 2020

The U.S. directed many of its new tariff increases on the Chinese EV industry, targeting imports such as semiconductors, lithium-ion batteries, and other battery parts.

Notably, tariffs on electric vehicles from China were bumped to 100% and new tariffs on certain critical minerals, which are essential for manufacturing battery parts and semiconductors, were introduced.

Medical-related products, such as medical and surgical gloves and certain personal protective equipment like face masks were also impacted by the new tariff increases. Some of these items were previously granted exclusions from Section 301 tariffs due to COVID-19.

Syringes and needles, which were previously not subjected to any tariffs, were also hit with a new 50% tariff.

Section 301 Tariffs Still Going Strong

Tariffs are taxes imposed by a country on imported goods, increasing their price to protect domestic industries, regulate trade, or generate revenue for the government.

These new tariff actions were introduced under Section 301, a provision that allows the U.S. government to investigate and respond to unfair trade practices by foreign countries.

Section 301 tariffs on Chinese goods were first introduced by former President Donald Trump in 2018, which sparked retaliatory tariffs on China and set off a years-long trade war between the two countries.

Currently, Section 301 tariffs apply to over $300 billion worth of Chinese imports.

The post Comparing New and Current U.S. Tariffs on Chinese Imports appeared first on Visual Capitalist.