![]()

See this visualization first on the Voronoi app.

A Critical Look at Tesla’s Valuation

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data‑driven charts from a variety of trusted sources.

- Tesla trades at a 189x trailing-12-month (TTM) earnings multiple—more than triple Nvidia’s 55x and nearly six times Apple’s 33x.

- Meanwhile, second‑quarter revenue fell 12% year‑over‑year and automotive operating margin sits near 4%, much lower than GM’s 7%.

- Bulls still see a $500 share‑price path tied to robotaxis, Dojo, and humanoid robots, but the market is already paying ~145x forward earnings for that optionality.

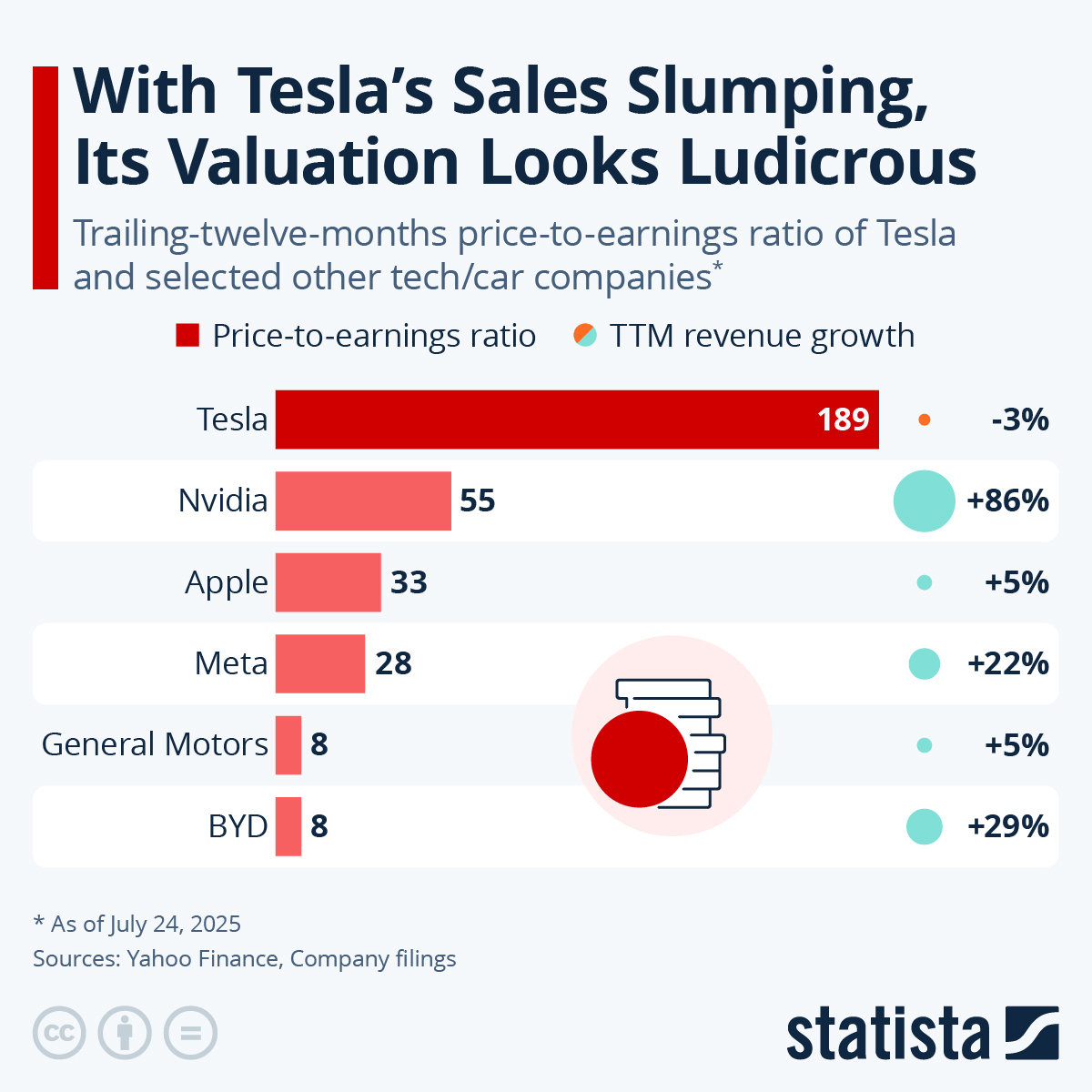

Tesla’s market narrative has long oscillated between old‑economy car manufacturing and Silicon‑Valley‑style moonshots. The chart below, created by Statista from company filings, makes the dissonance hard to ignore.

Below, we see that Tesla’s P/E towers above selected peers while its revenue is the only one in outright decline—an uncomfortable combination for value‑minded investors.

| Company | P/E Ratio | TTM Revenue Growth (%) |

|---|---|---|

| Tesla | 189 | -3 |

| Nvidia | 55 | 86 |

| Apple | 33 | 5 |

| Meta | 28 | 22 |

| General Motors | 8 | 5 |

| BYD | 8 | 29 |

The Multiple That Defies Gravity

Statista pegs Tesla’s trailing P/E at 189—more than the combined ratio of Meta, Apple and GM in the same snapshot. Even if we switch to forward estimates, Reuters puts the stock at 145x earnings, a level typically reserved for early‑stage software firms rather than manufacturers turning out 1.8 million cars a year.

Sliding Fundamentals

Tesla’s latest 10‑Q shows revenue down 12% and automotive gross margin still barely 15%, less than half its 2022 peak. Free cash flow for the quarter also collapsed 89%, according to Bloomberg’s earnings‑day recap, underscoring how price cuts and factory re‑tooling are eating into liquidity.

By contrast, Nvidia grew sales 86% and Apple eked out 5% growth over the same period.

The Bull Case: Autonomy and AI

Wedbush analyst Dan Ives posits that Tesla is “the most undervalued AI play,” assigning a $500 price target that implies a 100% upside.

He argues Dojo supercomputers, a global Robotaxi fleet, and the Optimus humanoid robot could unlock high‑margin, platform‑like revenue streams worth $1 trillion over time.

Bears Ask: How Long Can Vision Trump Math?

Skeptics counter that paying software‑like multiples for a company with shrinking top‑line and mid‑single‑digit margins is a recipe for disappointment. As Reuters notes, GM earns more per vehicle today, yet trades at just 8x earnings. Unless Tesla can quickly reignite growth—or prove its robotaxi dreams—its valuation gap may face gravity.

For more background on how Elon Musk’s company reached its current crossroads, see Tesla’s origin story.

Learn More on the Voronoi App

Explore related analysis in Electric cars are booming in Europe – Tesla under pressure on the Voronoi app for a regional look at EV competition.