Content originally published at iBankCoin.com

This little pink sheeter ran up 20,000% because MUH Bitcoin, hitting a market cap of $12.6b, and now it's all unraveling under the hard realities of mathematics driven by greed.

Even down 65% for the day, on 11,000 shares traded, the market cap is still over $4 billion.

According to the most recent financials published with the SEC, the company had a whole $3 million in cash.

Revenues were a touch under $500,000 with losses of $1.2 million.

Regarding their recent stock sale:

On June 7, 2017, the Company entered into (i) a Share Purchase Agreement (the “Restricted Share Purchase Agreement”) with Crypto Sub, and John B. Thomas P.C., in its sole capacity as representative for certain shareholders of the Company; and (ii) a Share Purchase Agreement (the “Free Trading Share Purchase Agreement”, and together with the Restricted Share Purchase Agreement, the “Share Purchase Agreements”) with Crypto Sub, Uptick Capital, LLC (“Uptick Capital”) and John B. Thomas P.C., in its sole capacity as representative for certain shareholders of the Company. Pursuant to the Share Purchase Agreements, the shareholders of the Company sold an aggregate of 11,235,000 shares of common stock of the Company to Crypto Sub and 100,000 shares of common stock of the Company to Uptick Capital, representing an aggregate of 100% of the issued and outstanding common stock of the Company as of such date, for aggregate proceeds of $411,650, including escrow and other transaction related fees to the selling shareholders (the “Stock Sale”). A portion of the acquisition cost equal to $399,300 is expensed as a general and administrative expense in the accompanying consolidated statement of operations.

The entire set up is highly suspect, reminiscent of the countless shell games played before by pink sheet operators.

Here are the clowns behind this brazen scheme.

On March 9, 2017, Crypto Sub issued 125,000 shares of common stock of Crypto Sub to an employee of Crypto Sub, in exchange for an initial investment made in the form of cryptocurrency, valued at $100,000, based on the fair value of the investment on the date of such investment. On June 7, 2017, the employee received (i) 1,875,000 shares of common stock of Croe in connection with the Stock Dividend issued by Crypto Sub, and (ii) 1,125,000 shares of common stock of Croe in exchange for all of the employee’s shares of Crypto Sub in connection with the Share Exchange.

On March 9, 2017, Crypto Sub issued 300,000 shares of common stock of Crypto Sub to James Gilbert, the President of the Company, in exchange for $200,000. On June 7, 2017, Mr. Gilbert received (i) 4,500,000 shares of common stock of Croe in connection with the Stock Dividend issued by Crypto Sub, and (ii) 2,700,000 shares of common stock of Croe in exchange for all of his shares of Crypto Sub in connection with the Share Exchange.

On March 9, 2017, Crypto Sub issued (i) 125,000 shares of common stock of Crypto Sub to Redwood Fund LP (“Redwood”) in exchange for $200,000; and (ii) 125,000 shares of common stock of Crypto Sub to Imperial Strategies, LLC (“Imperial Strategies”) in exchange for certain services rendered, valued at $200,000, as of the date of such issuance. Michael Poutre, the Chief Executive Officer of the Company, and Ron Levy, the Chief Operating Officer of the Company, are Chief Executive Officer and Chief Operating Officer, respectively, of Ladyface Capital, LLC, the General Partner of Redwood, and, as a result, had an indirect material interest in the shares owned by Redwood. Mr. Poutre is the sole member of MP2 Ventures, LLC, a member of Imperial Strategies, and, as of September 1, 2017, Mr. Poutre and Mr. Levy are Chief Executive Officer and Chief Operating Officer, respectively of Imperial Strategies and, as a result, have an indirect material interest in the shares owned by Imperial Strategies. On June 7, 2017, each of Redwood and Imperial Strategies received (i) 1,875,000 shares of common stock of Croe in connection with the Stock Dividend issued by Crypto Sub, and (ii) 1,125,000 shares of common stock of Croe in exchange for all of their shares of Crypto Sub in connection with the Share Exchange.

As of September 30, 2017, the Company pre-paid consulting fees of $60,000 reflected in prepaid expenses to MP2 Ventures, LLC, of which Michael Poutre, the Chief Executive Officer of the Company, is the sole member, for his services rendered as Chief Executive Officer.

Thus far, it appears James Gilbert, Michael Poutre, and Ron Levy are making a killing on this run up.

Additionally, a firm named John B. Thomas P.C., Uptick Capital, and Crypto Sub seem to be facilitating the transactions, acting as bankers for CRCW.

a Share Purchase Agreement (the “Free Trading Share Purchase Agreement”, and together with the Restricted Share Purchase Agreement, the “Share Purchase Agreements”) with Crypto Sub, Uptick Capital, LLC (“Uptick Capital”) and John B. Thomas P.C., in its sole capacity as representative for certain shareholders of the Company. Pursuant to the Share Purchase Agreements, the shareholders of the Company sold an aggregate of 11,235,000 shares of common stock of the Company to Crypto Sub and 100,000 shares of common stock of the Company to Uptick Capital, representing an aggregate of 100% of the issued and outstanding common stock of the Company as of such date, for aggregate proceeds of $411,650, including escrow and other transaction related fees equal to $1,525, to the selling shareholders (the “Stock Sale”). A portion of the acquisition cost equal to $399,300 is expensed as general and administrative expense in the accompanying statement of operations.

Crypto Sub is run by Michael Poutre, who is also CEO of CRCW.

Their CFO is a gent named Ivan Ivankovich, who was once CFO of Yellow Pages, former Ernst and Young stock.

Ivan brings more than 27 years of finance and operations management experience to his role as co-founder and Managing Partner of Full Stack Finance. The firm specializes in providing finance and accounting outsource services to early to mid stage venture-/angel-/PE-backed technology companies. His industry experience includes technology, internet services, online advertising, digital media publishing and telecommunications.

Ivan previously served as CFO of YellowPages.com and as Vice President, Portfolio Operations with Platinum Equity, a global acquisition firm specializing in the operation of technology companies. At Platinum Equity, Ivan’s primary responsibility was the management and operational supervision of its portfolio companies.

Ivan started his career with Ernst & Young joining their audit practice in Los Angeles. He is a Certified Public Accountant and a member of the California Society of CPA’s.

Mr. Poutre has a bit of a checkered past.

n July 16, 2010, Mr. Poutre entered into a Letter of Acceptance, Waiver and Consent (AWC) with the Financial Industry Regulatory Authority (FINRA) relating to alleged rule violations while he was associated with Maxx Trade, Inc. (Maxx Trade). The AWC set forth FINRA’s findings that Mr. Poutre had violated conduct rules by charging customers more than a fair markup for certain bond transactions. Without admitting or denying the allegations and findings against him, Mr. Poutre consented to a $5,000 fine and suspension from association with a FINRA member in all capacities for thirty (30) calendar days. Mr. Poutre signed the AWS without representation of counsel.

In another AWS related to Maxx Trade, on April 20, 2009, Mr. Poutre, without admitting or denying the allegations and findings against him, consented to a $5,000 fine and two-year suspension from association with a FINRA member in all capacities. FINRA alleged that Mr. Poutre had failed to provide complete responses to the staff’s requests for information and documents in violation of FINRA rules. Mr. Poutre signed the AWS without representation of counsel.

On November 8, 2006, Mr. Poutre submitted an Offer of Settlement (the “Offer”) to the National Association of Securities Dealers, Inc. (NASD), the predecessors of FINRA. The NASD accepted the Offer and issued an Order Accepting Offer of Settlement (the “Order”). Without admitting or denying the allegations and findings against him, Mr. Poutre consented to a $5,000 fine and ten business day suspension in all capacities. NASD alleged that Mr. Poutre had failed to provide certain emails the staff’s requests for emails in violation of NASD rules. Mr. Poutre signed the Offer of Settlement without representation of counsel.

In September 2009, Mr. Poutre filed a voluntary petition for a Chapter 7 bankruptcy in the U.S. Bankruptcy Court for the Central District of California. Discharge was finalized on November 16, 2010.

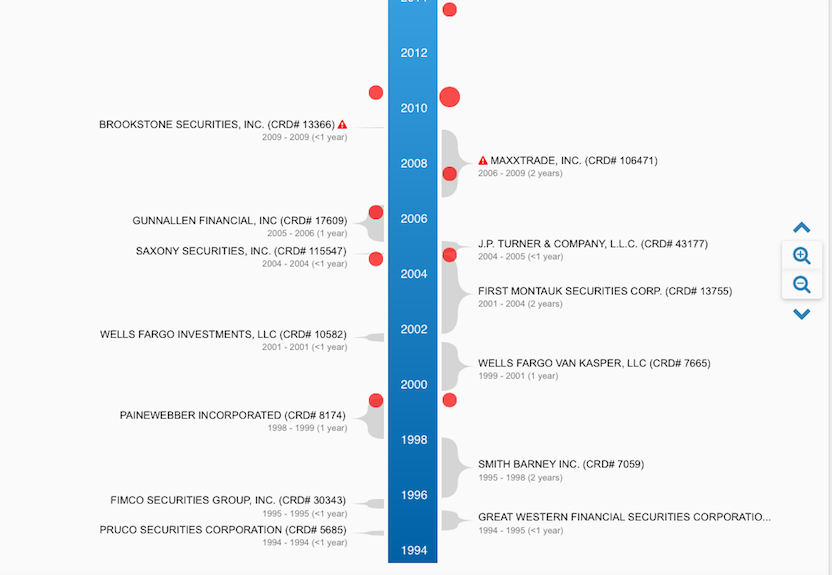

According to the FINRA website, Mr. Poutre has 10 disclosures and has bounced around from firm to firm like a god damned pinball since 1994.

Back in 2005, Mr. Poutre was discussed online for meddling with two bucket shops who attempted to merge.

And here are the disclosures, which are so numerous I am shocked he hasn't been banned from the industry.

2013: Allegations

PLAINTIFF, AN EARLY-STATGE INVESTOR IN TOUCHTUNES MUSIC CORP., ALLEGES THAT THE DEFANDANTS TOUCHTUNES MUSIC INC.,

VARIOUS INSIDERS OF TOUCHTUNES AND UBS AND PAINEWEBBER ENGAGED IN 'MINORITY SHAREHOLDER ABUSE, OPPRESSION, FRAUD AND SQUEEZE-OUT.' PLAINTIFF ALLEGES THAT PLANINTFF MADE HIS INITIAL PURCHASE OF THE TOUCHTUNES SHARES IN 1998 AFTER

RECIEVING RESEARCH AND ADVICE FROM HIS PAINEWEBBER SECURITIES BROKER REGARDING TOUCHTUNES. TIME FRAME: 1998-2006.

Damage Amount Requested

$12,000,000.00

2010: Allegations

NASD RULES 2110, 2440 - MICHAEL A. POUTRE PLACED ORDERS FOR THE SALE OF CORPORATE BONDS AND PLACED CHARGES ON THE ORDERS FOR MARKUPS, WHICH WERE NOT FAIR AND REASONABLE, IN CONSIDERATION OF THE FACTORS SET FORTH IN NASD INTERPRETATIVE MATERIAL 2440(B). POUTRE SOLICITED SECURITIES TRANSACTIONS IN ACTIVELY TRADED, LIQUID CORPORATE BOND TRANSACTIONS FOR CUSTOMERS AND CHARGED THE CUSTOMERS MARKUPS OR MARKDOWNS THAT EXCEEDED 3% AND $400. MOST OF THE TRANSACTIONS WERE LARGE AND, BECAUSE THEY INVOLVED CORPORATE BONDS, A MARKUP OR MARKDOWN OVER 3% WOULD BE CONSIDERED EXCESSIVE. THE CORPORATE BONDS INVOLVED WERE READILY AVAILABLE AND INVOLVED LARGE TRANSACTIONS OF HIGHER PRICED SECURITIES, WHICH JUSTIFIED LOWER PERCENTAGE RATES. THE MARKUPS AND MARKDOWNS WERE NOT DISCLOSED TO THE CUSTOMERS AND THE NUMBER OF VIOLATIVE TRANSACTIONS ESTABLISHES A PATTERN OF EXCESSIVE MARKUPS AND MARKDOWNS. NOTHING IN POUTRE'S OR HIS MEMBER FIRM'S BUSINESS ACTIVITIES JUSTIFIED THE MARKUPS OR MARKDOWNS OF OVER 3%.

Resolution

Acceptance, Waiver & Consent(AWC)

Sanctions

Suspension

Registration Capacities Affected

ANY CAPACITY

Duration

30 DAYS

Start Date

8/2/2010

End Date

8/31/2010

Regulator Statement

WITHOUT ADMITTING OR DENYING THE FINDINGS, POUTRE CONSENTED TO THE DESCRIBED SANCTION AND TO THE ENTRY OF FINDINGS; THEREFORE, HE IS SUSPENDED FROM ASSOCIATION WITH ANY FINRA MEMBER IN ANY CAPACITY FOR 30 DAYS. THE SUSPENSION IS IN EFFECT FROM AUGUST 2, 2010 THROUGH AUGUST 31, 2010.

Broker Comment

IN CONNECTION WITH THE EVENTS RELATED TO THIS DISCLOSURE ON MAY 20, 2009, I FILED A LAWSUIT AGAINST MAXX TRADE IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF KENTUCKY. I CLAIMED AMONG OTHER THINGS, THAT THE PRINCIPAL OWNERS OF MAXX TRADE ADDED, WITHOUT MY KNOWLEDGE, A SEPARATE COMMISSION ON TOP OF THE FAIR AND REASONABLE COMMISSION I CHARGED MY BOND CLIENTS. THIS RESULTED IN THE IMPERMISSIBLE MARK-UPS THAT WERE THE SUBJECT OF THIS DISCLOSURE.

I ALSO MADE THESE ALLEGATIONS IN CONNECTION WITH A PARALLEL FINRA ARBITRATION AGAINST MAXX TRADE AND ITS PRINCIPALS. PURSUANT TO THE ARBITRATION, ON FEBRUARY 15, 2011 I WAS AWARDED COMPENSATORY DAMAGES, INTEREST ATTORNEYS' FEES, AND COSTS WITH RESPECT TO MY CLAIMS AGAINST MAXX TRADE AND ITS PRINCIPALS.

Here he was suspended for two years.

2010 Allegations:

FINRA RULES 2010, 8210: POUTRE FAILED TO PROVIDE A COMPLETE RESPOND TO FINRA REQUESTS FOR INFORMATION AND DOCUMENTS IN A PENDING INVESTIGATION CONCERNING HIS OUTSIDE BUSINESS ACTIVITIES.

Resolution

Acceptance, Waiver & Consent(AWC)

Sanctions

Civil and Administrative Penalty(ies)/Fine(s)

Amount

$5,000.00

Sanctions

Suspension

Registration Capacities Affected

ALL CAPACITIES

Duration

TWO YEARS

Start Date

6/7/2010

End Date

6/6/2012

Regulator Statement

WITHOUT ADMITTING OR DENYING THE FINDINGS, POUTRE CONSENTED TO THE DESCRIBED SANCTIONS AND TO THE ENTRY OF FINDINGS; THEREFORE, HE IS FINED $5,000 AND SUSPENDED FROM ASSOCIATION WITH ANY FINRA MEMBER IN ANY CAPACITY FOR TWO YEARS. THE FINE IS DUE AND PAYABLE EITHER IMMEDIATELY UPON RE-ASSOCIATION WITH A MEMBER FIRM FOLLOWING HIS SUSPENSION OR PRIOR TO ANY REQUEST FOR RELIEF FROM ANY STATUTORY DISQUALIFICATION RESULTING FROM THIS OR ANY OTHER EVENT OR PROCEEDING, WHICHEVER IS EARLIER. THE SUSPENSION IS IN EFFECT FROM JUNE 7, 2010, THROUGH JUNE 6, 2012.

Broker Comment

IN CONNECTION WITH THE EVENTS RELATED TO THIS DISCLOSURE, ON MAY 20, 2009, I FILED A LAWSUIT AGAINST MAXX TRADE IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF KENTUCKY. I CLAIMED AMONG OTHER THINGS, THAT THE PRINCIPAL OWNERS OF MAXX TRADE FILED CLAIMS WITH FINRA THAT WERE INACCURATE AND DEFAMATORY RESULTING IN I BECOMING THE SUBJECT OF THE FINRA INQUIRY THAT WAS THE SUBJECT OF THIS DISCLOSURE.

I ALSO MADE THESE ALLEGATIONS IN CONNECTION WITH A PARALLEL FINRA ARBITRATION AGAINST MAXX TRADE AND ITS PRINCIPALS. PURSUANT TO THE ARBITRATION, ON FEBRUARY 15, 2011 I WAS AWARDED COMPENSATORY DAMAGES, INTEREST, ATTORNEYS' FEES, AND COSTS WITH RESPECT TO MY CLAIMS AGAINST MAXX TRADE AND ITS PRINCIPALS.

This man has been a wrecking ball in the industry and now presides over a multi-billion dollar scam. Ca