Exxon Mobil (XOM) has little to brag about over the past 6-years, as its performance is flat and it has lagged the S&P 500’s gains by nearly 95% (See Chart Below). If one looks back 10-years, XOM hasn’t made any gains either! Could times be about to change?

CLICK ON CHART TO ENLARGE

Other than collecting a nice dividend, it has been painful to own XOM over the past 6-years and the past decade, as its performance has been flat. Could this lagging performance be about to end? Exxon finds itself testing an important line in the sand below, that could tell us a ton about its future-

CLICK ON CHART TO ENLARGE

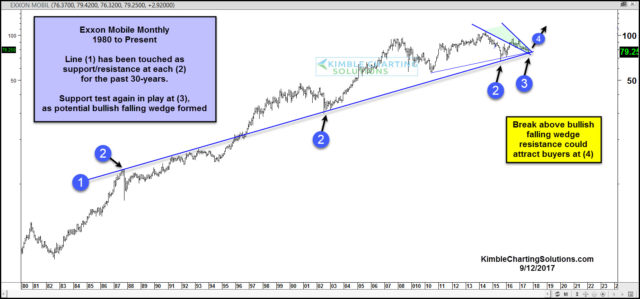

Line (1) has been both support and resistance several times at each (2) over the past 30-years. The decline over the past couple of years has XOM testing support line (1) at (3). While testing this line, XOM could be forming a bullish at (3).

The Power of the Pattern is of the opinion that if falling wedge resistance is taken out at (4), it could attract buyers to this out of favor company. A nice risk/reward set up is in play, as (1) becomes a nice stop loss for long positions, should selling pressure take place.

from Kimble Charting Solutions. We strive to produce concise, timely and actionable chart pattern analysis to save people time, improve your decision-making and results

Send us an email if you would like to see sample reports or a trial period to test drive our Premium or Weekly Research

Receive Chris Kimble's research by email posted to his blog daily https://kimblechartingsolutions.com/newsletter-preferences/

Email [email protected]

Call us Toll free 877-721-7217 international 714-941-9381

Website: KIMBLECHARTINGSOLUTIONS.COM