Written By Marcus Lu

Published August 23, 2022

•

Updated August 23, 2022

•

TweetShareShareRedditEmail

The following content is sponsored by Hinrich Foundation

Global Trade Series: Asia’s Digital Economy

Over the past several decades, Asia has enjoyed robust economic growth.

Historically speaking, most of this growth was concentrated in China, and was due to a rapid expansion of manufacturing capability. Today, economic growth is being increasingly driven by the digital economy, and it’s spreading to many more countries in the region.

In this infographic from the Hinrich Foundation, we take a closer look at how trade and digitalization is shaping Asia’s future.

A Historic E-Commerce Boom

It’s well documented that the COVID-19 pandemic was a catalyst for greater e-commerce adoption. In the U.S. for example, e-commerce’s share of total retail sales grew from 11% in 2019 to 15.3% in 2021.

This trend is even more pronounced in Southeast Asia, where the number of online shoppers has increased by 70 million since the beginning of the pandemic. For context, that’s roughly equal to the entire population of the UK.

Furthermore, if we look at the top five countries by e-commerce sales growth in 2022, three are located in Southeast Asia. Widening our scope to Asia in general, this climbs to four out of five.

| Country | Region | Annual sales growth (%) |

|---|---|---|

| Philippines | Southeast Asia | 25.9% |

| India | South Asia | 25.5% |

| Indonesia | Southeast Asia | 23.0% |

| Brazil | Latin America | 22.2% |

| Vietnam | Southeast Asia | 19.0% |

| Global average | -- | 9.2% |

Underpinning this growth is Asia’s embracement of the super app—an application that includes many digital services under one umbrella. Examples include South Korea’s Kakao (53M users), Singapore’s Grab (180M users), and China’s WeChat (1B users).

These services originally served a single purpose such as messaging, but have since grown into massive ecosystems where businesses and consumers can connect. Under the WeChat umbrella, users can access digital payment services, social networks, food delivery, shopping, and more.

Beware the Digital Divide

Unique challenges are threatening the growth of Asia’s digital economy. Here are three examples.

1. Digital Neo-Mercantilism

Neo-mercantilism is a regime that uses trade restrictions (limiting imports) as a means of increasing domestic income and employment. These policies are becoming more common in the digital economy, especially between the U.S. and China.

In 2019, the U.S. blacklisted Huawei, restricting it from doing business with domestic firms such as Google. This continues to significantly hamper the company, which was once the world’s largest smartphone manufacturer. In China, a similar story is unfolding. Data restrictions and other regulations have famously driven out American tech firms such as Uber and Yahoo.

2. Skills Gaps

Due to technological innovation, more and more businesses are looking to hire people with digital skills. For context, a 2021 survey of over 2,000 employers across Asia-Pacific found the most in-demand skills to be:

- Using cloud-based tools such as CRM software

- Developing and deploying cybersecurity protocols

- Managing migration from on-premises to the cloud

- Providing technical support

- Digital marketing skills

Unfortunately, 67% (two thirds) of Asian workers don’t feel confident that they’re gaining these skills fast enough. Among people aged 55 and above, this percentage rises to 83%.

If governments and businesses fail to adequately invest in education, it’s likely their country will fall behind. The survey also found that 97% of organizations recognize the need for digital training, but just 29% had a plan for doing so.

3. Fragmented Regulatory Landscape

Inconsistent regulations across Asia are having a negative impact on businesses.

For example, in 2021, eTrade Alliance surveyed 1,300 firms in Southeast Asia. A key finding was that 30% of businesses had lost an online sale due to cross-border payment restrictions. Resolving these issues should be a top priority, especially given the region’s rapid growth in number of online shoppers.

Some countries such as Thailand have made progress in improving payment interoperability. Its central bank recently launched a QR code payment system with Laos, Cambodia, and Vietnam. Thailand has also cooperated with Singapore, allowing customers of participating banks to transfer up to $800 daily between the two countries.

Recent Trade Agreements Involving Asia

Here are three major trade agreements that are likely to impact Asia’s digital economy.

1. CPTPP

The CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership) is a trade agreement among 11 nations, signed in 2018.

It features a comprehensive e-commerce chapter that standardizes digital trade rules and ensures the free flow of data. See below for a list of member countries.

| Signatories | GDP (USD trillions) | Population |

|---|---|---|

| Australia | $1.54 | 25,739,000 |

| Brunei | $0.01 | 441,532 |

| Canada | $1.99 | 38,246,000 |

| Chile | $0.32 | 19,212,000 |

| Japan | $4.94 | 125,681,000 |

| Malaysia | $0.37 | 32,776,000 |

| Mexico | $1.29 | 130,262,000 |

| New Zealand | $0.25 | 5,122,000 |

| Peru | $0.22 | 33,359,000 |

| Singapore | $0.40 | 5,453,000 |

| Vietnam | $0.36 | 98,168,000 |

| Signatories Total | $11.69 | 514,459,532 |

| Global total | $96.1 | 7,840,000,000 |

Altogether, CPTPP signatories represent 12.2% of global GDP, and 6.6% of global population.

Recent research on the impacts of CPTPP suggest that the agreement has already benefitted businesses. Among 530 firms surveyed, 36% said the CPTPP helped them diversify into new markets, while 45% said it helped them gain more foreign customers.

2. RCEP

The Regional Comprehensive Economic Partnership (RCEP) is a trade agreement among 15 Asia-Pacific nations, signed in 2020. See below for a list of member countries.

| Signatories | GDP (USD trillions) | Population |

|---|---|---|

| Australia | $1.54 | 25,739,000 |

| Brunei | $0.01 | 441,532 |

| Canada | $1.99 | 38,246,000 |

| Chile | $0.32 | 19,212,000 |

| Japan | $4.94 | 125,681,000 |

| Malaysia | $0.37 | 32,776,000 |

| Mexico | $1.29 | 130,262,000 |

| New Zealand | $0.25 | 5,122,000 |

| Peru | $0.22 | 33,359,000 |

| Singapore | $0.40 | 5,453,000 |

| Vietnam | $0.36 | 98,168,000 |

| Signatories Total | $11.69 | 514,459,532 |

| Global total | $96.1 | 7,840,000,000 |

Chapter 12 of this agreement is designed to promote e-commerce, but it has its limitations. On one hand, the RCEP prohibits against requiring localized data. Data localization refers to any restrictions on cross-border data flows.

On the other hand, signatories have the ability to restrict data flows where they deem necessary for “national security”. The definition of national security can be ambiguous at times. Furthermore, Chapter 12 does not apply to government procurement, government information, and electronic service delivery.

3. IPEF

The Indo-Pacific Economic Framework (IPEF) is not yet a formal agreement, but rather an economic initiative launched by the U.S. in 2022.

It includes 14 member states, and has parallels with the Trans-Pacific Partnership, a precursor to the CPTPP which the U.S. withdrew from in 2017. See below for a list of member countries.

| Signatories | GDP (USD trillions) | Population |

|---|---|---|

| Australia | $1.54 | 25.739.000 |

| Brunei | $0.01 | 441,532 |

| Fiji | $0.005 | 902,899 |

| India | $3.17 | 1,390,000,000 |

| Indonesia | $1.19 | 276,361,000 |

| Japan | $4.94 | 125,681,000 |

| South Korea | $1.80 | 51,744,000 |

| Malaysia | $0.37 | 32,776,000 |

| New Zealand | $0.25 | 5,122,000 |

| Philippines | $0.39 | 111,046,000 |

| Singapore | $0.40 | 5,453,000 |

| Thailand | $0.51 | 69,950,000 |

| United States | $23.00 | 331,893,000 |

| Vietnam | $0.36 | 98,168,000 |

| Total | $37.94 | 252,527,7431 |

| Global | $96.10 | 7,840,000,000 |

According to a press release by the White House, the IPEF intends to establish standards on cross-border data flows and address issues such as online privacy and the unethical use of artificial intelligence.

Towards a Digital Trade Zone

Asia is in the midst of a historic e-commerce boom, supercharged by COVID-19 and its lasting impacts on the global economy. By forging new trade agreements and reducing digital barriers, Asian governments can ensure this momentum lasts.

The Hinrich Foundation is a unique Asia-based philanthropic organization that works to advance mutually beneficial and sustainable global trade through research and educational programs.

Please enable JavaScript in your browser to complete this form.Subscribe to our free newsletter and get your mind blown on a daily basis: *Sign up

Related Topics: #trade #asia #e-commerce #ecommerce #digital economy #digitalization #trade agreement #Hinrich Foundation #asian trade

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Global Trade Series: Asia's Digital Economy";

var disqus_url = "https://www.visualcapitalist.com/sp/global-trade-series-asias-digital-economy/";

var disqus_identifier = "visualcapitalist.disqus.com-151796";

You may also like

-

Misc4 days ago

All the Contents of the Universe, in One Graphic

We explore the ultimate frontier: the composition of the entire known universe, some of which are still being investigated today.

-

Politics5 days ago

Ranked: Top 10 Countries by Military Spending

As geopolitical tensions began to heat up around the world, which nations were the top military spenders in 2021?

-

Green6 days ago

Explained: The Relationship Between Climate Change and Wildfires

More carbon in the atmosphere is creating a hotter world—and gradually fueling both climate change and instances of wildfires.

-

Economy1 week ago

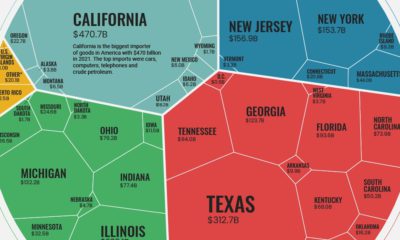

Visualized: The Value of U.S. Imports of Goods by State

U.S. goods imports were worth $2.8T in 2021. From east coast to west, this visualization breaks down imports on a state-by-state basis

-

Misc1 week ago

Sharpen Your Thinking with These 10 Powerful Cognitive Razors

Here are 10 razors, or rules of thumb, that help simplify decision-making, inspired by a list curated by the investor and thought leader Sahil Bloom.

-

Misc2 weeks ago

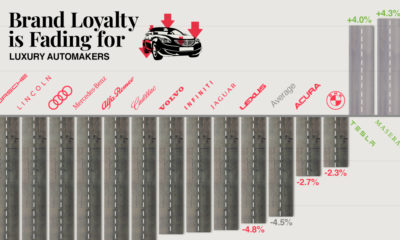

Brand Loyalty is Declining for Most Luxury Automakers

Brand loyalty has declined for most luxury automakers, but three brands—Tesla, Maserati, and Genesis—appear to have bucked the trend.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 300,000+ subscribers who receive our daily email *Sign Up

The post Global Trade Series: Asia’s Digital Economy appeared first on Visual Capitalist.