Written By Jenna Ross

Published November 10, 2022

•

Updated November 9, 2022

•

TweetShareShareRedditEmail

The following content is sponsored by ICE

How Sustainability Indices Can Support the Global ESG Push

The rise of sustainable investing has been fueled by a growing awareness of environmental, social, and governance (ESG) issues.

Alongside this, many investors want to have a positive impact. The issuance of impact bonds—where proceeds are used for a specific social or green cause—rose by 58% from 2020 to 2021.

Sustainability indices play a key role in the market, helping investors and portfolio managers benchmark performance and create new ESG investment products.

In this graphic from ICE, the last in a three-part series on the ESG toolkit, we explore the different types of ICE Sustainability Indices.

1. Green, Social, and Sustainable Bond Indices

What they do: Track bonds that promote climate change mitigation or that aim for positive social outcomes, such as reduced poverty levels.

Investors can also access sub-indices that track debt in specific currencies, or that cater to different risk appetites via investment grade or high yield bonds.

The face value of many of these sustainability indices has grown considerably in recent years.

| Index | Dec 2018 | Dec 2020 | Jul 2022 |

|---|---|---|---|

| ICE Green, Social, and Sustainability Bond Index |

$272B | $972B | $1.7T |

| ICE BofA Green Bond Index |

$240B | $572B | $980B |

| ICE Sustainable Bond Index |

$23B | $233B | $421B |

| ICE Social Bond Index |

$11B | $167B | $333B |

| ICE Global High Yield Green, Social & Sustainable Bond Index |

$6B | $29B | $84B |

| ICE Sustainability Linked Bond Index |

- | $4B | $82B |

| ICE Global High Yield Green Bond Index |

$6B | $26B | $66B |

Face value, also referred to as par value, is the dollar amount the issuer pays to the investor at maturity. It is fixed, whereas the price of a bond can fluctuate over time based on supply and demand forces.

2. Corporate ESG Indices

What they do: Filter out bonds of companies with certain business involvement, and weight towards companies with better ESG risk scores.

There are 3 main approaches:

- ESG Tilt: Filter out companies with significant involvement in controversial weapons and weight remaining constituents towards those with lower ESG risk scores.

- ESG Tilt With Duration Match: Mirror the ESG tilt method, but adjust to match the Parent Index’s interest rate exposure across rating and sector segments.

- ESG Best-In-Class*: Filter out companies with significant involvement in controversial weapons and/or that have the highest ESG risk scores. The remaining constituents are weighted to match the rating and sector allocations of the Parent Index.

*Best-in-Class refers to an approach used to identify companies with strong ESG ratings within their respective sectors.

These sustainability indices have lower risk scores than their parent indices, which are not ESG focused. For instance, U.S. High Yield Indices had at least 20% lower ESG risk scores than the associated parent index.

3. Climate Transition and Paris-Aligned Indices

What they do: Help investors pursue low carbon investment strategies, decarbonize their asset allocation and increase transparency.

ICE has a series of corporate bond indices that reduce the aggregate carbon exposure of their securities on a trajectory toward net zero by the end of 2050. The series includes versions that are subject to the requirements for labeling as Paris Aligned Benchmarked and Climate Transition Benchmarks, under EU and UK Benchmarks Regulation.

| Minimum Standards | Climate Transition Indices | Paris-Aligned Indices | |

|---|---|---|---|

| Climate Scenario | 1.5°C by 2050 | 1.5°C by 2050 | |

| Decarbonization Trajectory | 7% reduction per year | 7% reduction per year | |

| Minimum Scope 1, 2 & 3 Carbon Reduction vs Parent Index | 30% | 50% | |

| Baseline Exclusions | - Controversial weapons -Tobacco - Violators of the UNGC Principles - Companies that significantly harm one or more of the environmental objectives of the EU Taxonomy Regulation |

- Controversial weapons -Tobacco - Violators of the UNGC Principles - Companies that significantly harm one or more of the environmental objectives of the EU Taxonomy Regulation |

|

| Activity Exclusions | No | Fossil fuels |

The two types of sustainability indices have very similar minimum standards. However, Paris-Aligned Benchmarks have a higher decarbonization trajectory and exclude fossil fuels.

4. Global Carbon Future Indices

What they do: Track the price of carbon using some of the most actively traded carbon markets in the world. This includes the EU Emissions Trading Scheme, the Western Climate Initiative, the Regional Greenhouse Gas Initiative, and the UK Emissions Trading Scheme.

Tracking the price of carbon helps various groups:

- Policymakers can design policy accordingly

- Emitters and traders can hedge exposure to the rising price of carbon

- ETF providers can create investable funds based off a carbon index

The ICE Global Carbon Futures Index has historically outperformed several asset classes.

| Asset Class | Cumulative Total Return, Dec 2013-Jun 2022 |

|---|---|

| Global Carbon Futures | 729% |

| U.S. Equities | 143% |

| Precious Metals Futures | 36% |

| U.S. Investment Grade Bonds | 18% |

| Energy Futures | -10% |

See graphic for specific indices used.

The cumulative return of Global Carbon Futures was more than double that of other asset classes, and it also had the strongest risk-adjusted return.

Sustainability Indices: Helping ESG Investing Flourish

As the demand for ESG investments rises, so will the need for benchmarks that support the creation and management of portfolios.

A broad suite of sustainability indices will help investors:

- Promote climate change mitigation

- Aim for positive social outcomes

- Filter out certain business involvement

- Overweight companies with better ESG risk scores

- Pursue low carbon investment strategies

- Track the price of carbon

Backed with a rigorous methodology and detailed ESG data, these sustainability indices make ESG strategies actionable.To explore ICE’s broad range of sustainability indices, click here now.

Please enable JavaScript in your browser to complete this form.Subscribe to our free newsletter and get your mind blown on a daily basis: *Sign up

Related Topics: #sustainability #index #ESG #Intercontinental Exchange #ESG risk #Sustainability index #impact bonds #carbon futures #paris-aligned indices #esg benchmark

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "How Sustainability Indices Can Support the Global ESG Push";

var disqus_url = "https://www.visualcapitalist.com/sp/how-sustainability-indices-can-support-the-global-esg-push/";

var disqus_identifier = "visualcapitalist.disqus.com-152929";

You may also like

-

Money16 hours ago

The U.S. and China Account for Half the World’s Household Wealth

This visualization breaks down how household wealth is distributed around the world. Just 10 countries now account for 75% of total household wealth.

-

Green2 days ago

Visualizing Changes in CO₂ Emissions Since 1900

How much do global CO₂ emissions change on a year-to-year basis? Here, we show the annual rate of change in emissions since 1900.

-

Datastream3 days ago

Ranked: Top 10 Foreign Policy Concerns of Americans

As the world’s superpower, the U.S. has major influence in world events. Which foreign policy concerns stand out for Americans?

-

VC+5 days ago

What’s New on VC+ in November?

This month, along with regularly scheduled features, our special dispatches break down the IEA’s latest report and the state of the markets.

-

Misc6 days ago

Visualizing the Evolution of Vision and the Eye

The eye is one of the most complex organs in biology. We illustrate its evolution from a simple photoreceptor cell to a complex structure.

-

Technology6 days ago

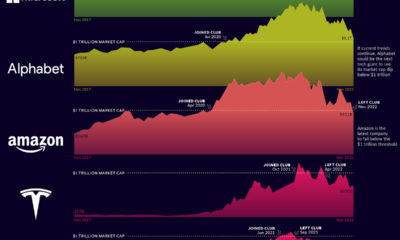

The Shrinking Trillion Dollar Market Cap Club

Economic woes and Fed tightening have taken their toll on the world’s most valuable companies. Here’s who is still part of the $1T club, and who’s…

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 350,000+ subscribers who receive our daily email *Sign Up

The post How Sustainability Indices Can Support the Global ESG Push appeared first on Visual Capitalist.