Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Many of these apparently high incomes are completely absorbed by high-cost upper middle class expenses.

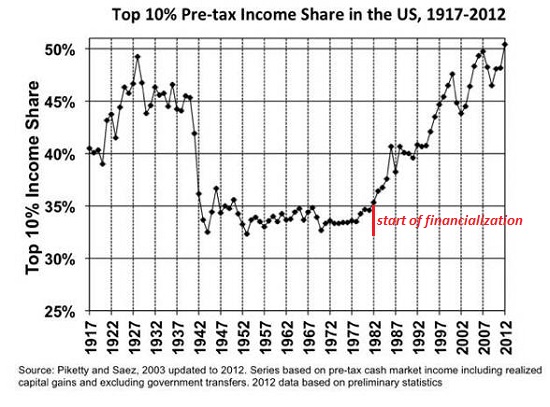

Since the top 10% takes home 50% of all household income, it follows that this top slice has most of the discretionary cash, i.e. net income left after taxes, servicing debt and paying for essentials such as food, utilities and housing.

It also follows that the discretionary spending of the top 10% is supporting much of the economy that is dependent on discretionary spending: tourism, eating out, personal trainers, etc.

[image]https://www.oftwominds.com/photos2014/income-top10a.jpg[/image]

The top 10% includes the thin slice of Financial Oligarchy (top .01%) and the top 1%. This skews the income and wealth of the top 10%. But if we set aside the top 1%, the next 10% still earns the lion's share of household income.

The top .1% can prop up Maserati sales and buy $5 million vacation homes, but there simply aren't enough super-wealthy to support the U.S. economy. As for the top 1%, they can prop up the local Porsche dealership and pay dock fees at the yacht club, but there aren't enough of them to support the entire economy, either: around 1.5 million qualify as top 1%.

So that leaves the upper-middle class, the roughly 12 million households that earn a disproportionate share of household income, with the task of spending enough discretionary cash to prop up an economy that depends heavily on consumer spending.

Many of these upper-middle class households are far more financially fragile than their substantial incomes suggest. The vast majority of these high-income households depend on two earners, each making substantial salaries, bonuses and benefits such as 401K retirement contributions.

Many of these apparently high incomes are completely absorbed by high-cost upper middle class expenses. $250,000 a year may look like a lot until you throw in a couple of kids attending private prep schools or college, healthcare costs that aren't covered by insurance, an enormous mortgage and sky-high property taxes.

The upper-middle class includes many people with wealth, but it also includes many people who have saved very little, and what they do have is in IRAs and 401Ks trapped in the stock market. Their slide to insolvency can be very quick once one high-earner loses their job and can't find another equally lucrative position in a few months.

Many of these people are vulnerable to a downturn because they own/operate small businesses in discretionary spending sectors--the ones that will get creamed as people cut discretionary spending. Others are sandwiched between kids in college and elderly parents, and their seemingly big incomes are fully allotted to essentials and the generations they are sandwiched between.

One job loss will crumble the entire house of cards. As local government revenues start crumbling along with corporate profits, many high-cost jobs in both thr public and private sectors will suddenly be vulnerable as managers are forced to seek the largest possible savings from job cuts.

The upper-middle class that's supported the "recovery" with massive discretionary spending is far more vulnerable to implosion/insolvency than is generally appreciated.