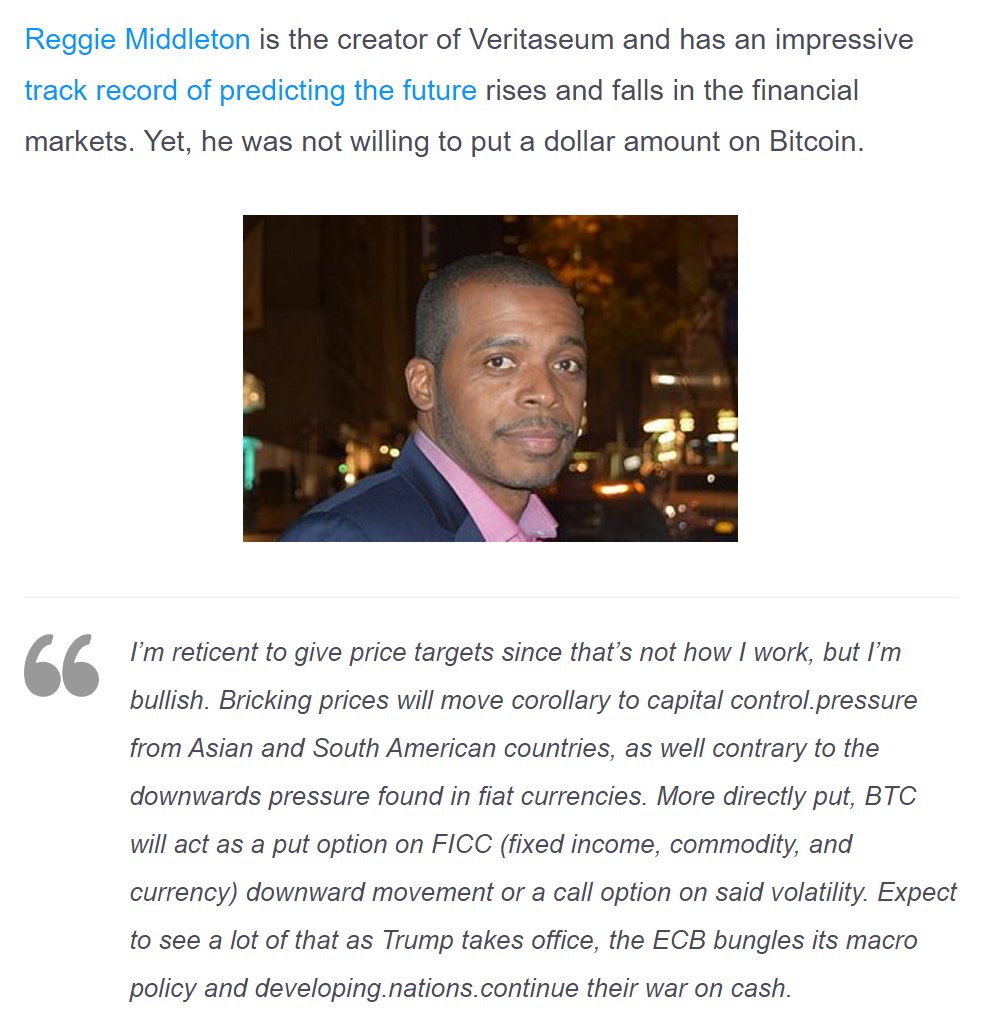

Reggie Middleton warns of Bitcoin pullback, then explains how practically the whole mainstream media machine is wrong

Reggie Middleton warns of Bitcoin pullback, then explains how practically the whole mainstream media machine is wrong

Bitcoin has dropped precipitously, and as is usual, we have the cacophony of instant digital currency pundits cackling about as if they had a clue. This is the inaugural post for the re-opening of BoomBustBlog's proprietary research (fresh paid content will be added over the next 24 hrs) and as such I want to kick it off with an indepth analysis of my Twitter stream on Bitcoin from this week.

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddleton$BTC is popping, up 56% in just over a month... 10% today, almost 20% for the new year. Pullback shouldnt surprise after requisite media pop

1:49 PM - 4 Jan 2017

- 55 Retweets

- 66 likes

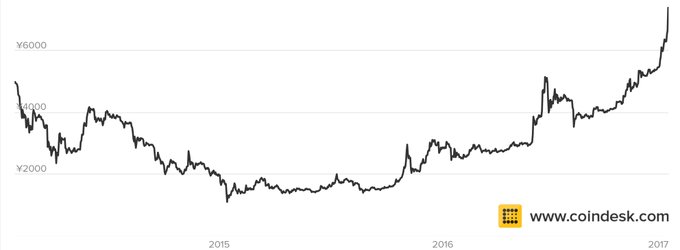

Bitcoin has been on a tear in 2016, particularly for the second half. 2017 started off strong, a bit too strong, so a pullback was obvious and inevitable. This is what I Tweeted on the 4th. If I'm not mistaken, it pulled back on the 5th.

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonChina facing massive capital outflows so .gov is implementing capital controls. Of course, this sends $BTC through the ROOF, as I've warned

1:02 PM - 3 Jan 2017

- 33 Retweets

- 55 likes

Of course, previous to that it roared. It actually roared for macro and fundamental reasons that many "experts" insisted on denying.

View image on Twitter

Follow

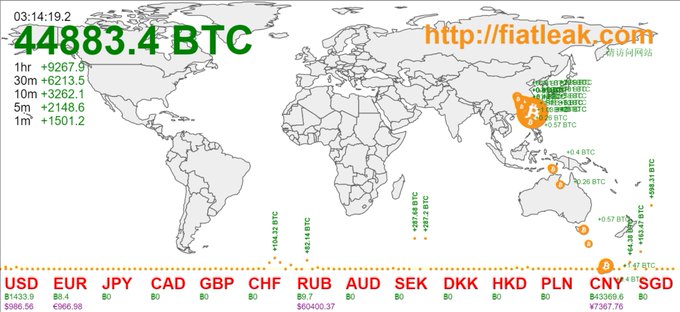

ReggieMiddleton @ReggieMiddleton$CNY #Yuan leaking from China into $BTC #blockchain, nearly $20M per hour, showing power of public blockchain & #Bitcoin in capital controls

1:09 PM - 3 Jan 2017

- 1010 Retweets

- 99 likes

Seeing is believing...

Follow

ReggieMiddleton @ReggieMiddletonIn $BTC $CNY pair flirting with all time hi due to https://China.gov cap controls+Trump+macro hard landing. Power of public blockchain

1:15 PM - 3 Jan 2017

- 44 Retweets

- 55 likes

2017 promises to be a tumultous year of geopolitical uncertainty and macro risk. This is an environment in which Bitcoin thrives.

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonWarned of China's problems last yr thru Veritaseum. They face the dreaded... TRILEMMA! Global reserve currency, NOT! https://blog.veritaseum.com/current-analysis/1-blog/83-despite-what-you-don-t-hear-in-the-media-it-s-all-out-currency-war-pt-2 …

1:20 PM - 3 Jan 2017

- 33 Retweets

- 33 likes

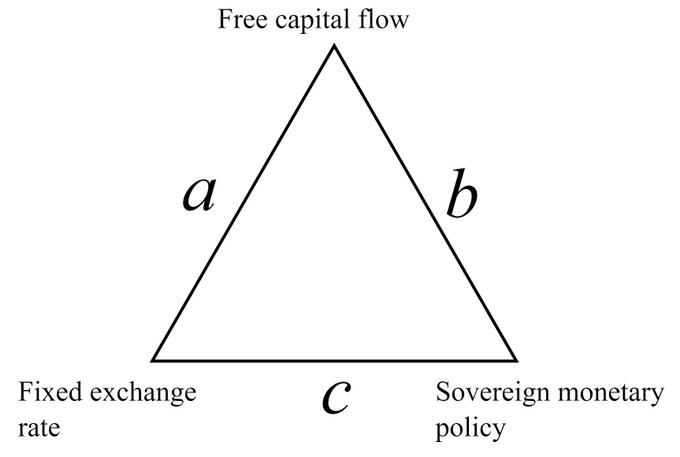

China's remnimbi has finally received reserve currency status, but with said status comes certain responsbilities that is running counter to the controlling methods China has employed in the past. Oh no! It's.... the Trilemma!

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonWith Chinese clamoring for blockchain token tech ($BTC), why aren't they kicking down bank's doors to get their tek? https://www.youtube.com/watch?v=o7kD9HCFjHw …

1:26 PM - 3 Jan 2017

- 22 Retweets

- 33 likes

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonThe level of #FiatLeak from $CNY to $BTC wholly corroborates my thesis of #PathogenicFinance & #P2PCapitalMarketshttps://www.youtube.com/watch?v=_vf8-Hl78pM&t=4s …

1:29 PM - 3 Jan 2017

- 33 Retweets

- 44 likes

Mucho yuan fiat was leaking (gushing?) into the bitcoin blockchain. Bitcoin's blockchain is already a global, anitfragile, counterparty risk-free P2P value exchange. This is what our technology, Veritaseum, is built upon.

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonExpect https://China.gov to (unwisely) move to curb $BTC in effort to stem (or more accurately, prevent widespread use) capital flight

2:22 PM - 3 Jan 2017

- 33 Retweets

- 11 like

Here, I warned that the Chinese government would likely step in. Quite the prescient comment, since lo and hehold several days later...

Chinese Regulators Exploring Bitcoin Connection to Capital Flight, and then we got China to Restrict Bitcoin Marketing, But Blockchain Firms Unaffected. Again, I was right on point!Restrict Bitcoin Marketing, But Blockchain Firms Unaffected

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonTrump, China, Russia, weakened Chancellor Merkel, bad bank assets, NIRP, public blockchains: 2017 “most macro/geopolitical” risk since WWII?

2:35 PM - 3 Jan 2017

- 22 Retweets

- 33 likes

As I've been warnng, think tanks and research firms interviewed by Bloomberg agree.

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddleton1 way to slow $BTC #Bitcoin down is to heavily regulate the points of fiat on/offramps - the exchanges, like US is doing via @coinbase

2:53 PM - 3 Jan 2017

- 11 Retweet

- 11 like

Reference my notes above...

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonWhat happens if https://China.gov successfully stifles onshore $BTC sale thru fiat offramp regulation? Incentivize an all $BTC economy

2:58 PM - 3 Jan 2017

- Retweets

- 11 like

This is something you dont' see in the mainstream media or most research notes. If China doesn't completely shut down bitcoin AND get the cooperation of other major offshore centers, any half assed attempt will simply increase the draw to bitcoin due to its very unique properties. China can actually usher in the P2P economy, by mistake. Reference The Onramp to Peer-to-Peer Capital Markets...

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonhttps://China.gov , largest, most prolific $BTC market can actually validate $BTC as fungible medium of exchange by trying 2 control it

3:01 PM - 3 Jan 2017

- Retweets

- 88 likes

Uh huh...

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonBest performing asset class of last year is already the best performing asset class of this year. $BTC at $1,084, up 0% since the Jan. 1

7:18 AM - 4 Jan 2017

- 22 Retweets

- 44 likes

Again, I reiterate the significant and material macro component in Bitcoin adoption, use and pricing...

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonMy $1.20 on #bitcoin 2017 price (remember, I roll with Central Banks, thus it was my 2 cents, but I levered up 60x!) https://bitcoinist.com/bitcoin-2017-experts-weigh-predictions/ …

8:34 AM - 4 Jan 2017

- 44 Retweets

- 1212 likes

This is the point, chronologically, where I warned about the BTC pullback...

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddleton$BTC is popping, up 56% in just over a month... 10% today, almost 20% for the new year. Pullback shouldnt surprise after requisite media pop

1:49 PM - 4 Jan 2017

- 55 Retweets

- 66 likes

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddleton2 yrs, 300% ago when $BTC was $380: Faith, Math & Circular Logic: Why Bitcoin's More Valuable Than ANY Fiat Currency https://blog.veritaseum.com/current-analysis/1-blog/69-faith-math-and-circular-logic-why-bitcoin-is-more-valuable-than-any-fiat-currency …

4:04 PM - 4 Jan 2017

- 66 Retweets

- 66 likes

For those (apparently the majority of the punditry who choose to opine) who don't know what Bitcoin is....

YouTube @YouTube

Follow

ReggieMiddleton @ReggieMiddletonWatch "Bitcoin, Autonomy & the Audacity of Access" on YouTube https://ow.ly/Nq1m100xH6c

4:38 PM - 4 Jan 2017

- 55 Retweets

- 55 likes

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonBitcoin within $25 of all time hi, sell orders gave resistance. Volume appears to be real & "Johnny come lately" media buzz may spike again

6:39 AM - 5 Jan 2017

- 11 Retweet

- 66 likes

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonAnd here's that $BTC pullback that I anticipated yesterday, down $140 since sunrise. Anticipated, expected & necessary...

7:58 AM - 5 Jan 2017

- 33 Retweets

- 99 likes

Even with the pullback and (now, 15%) drop, Bitcoin has performed very well....

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonNotice currency with most $BTC action, $USD is doing most of the transactions. $CNY usually 5x that of USD, now USD is 2x that of CNY, algos

8:27 AM - 5 Jan 2017

- 88 Retweets

- 99 likes

I've seen reports on the ground in China that way capital control avoidance was not a major contributor to Bitcoin activity. Well, the evidence that I've found says otherwise.

View image on Twitter

Follow

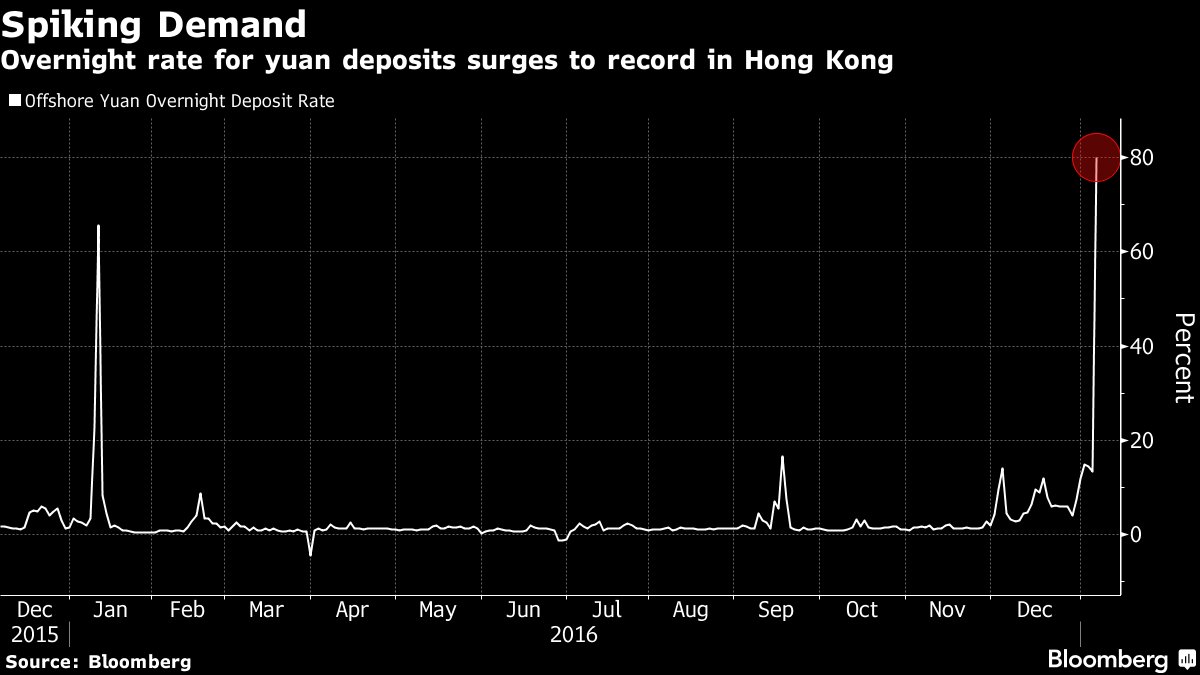

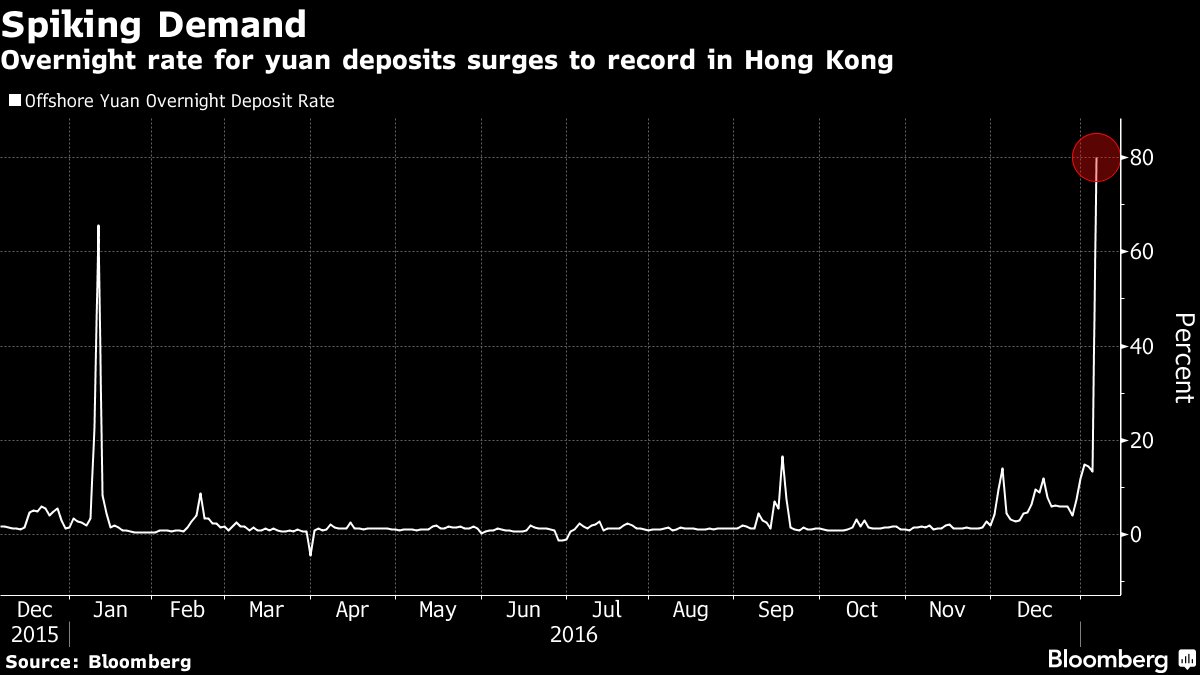

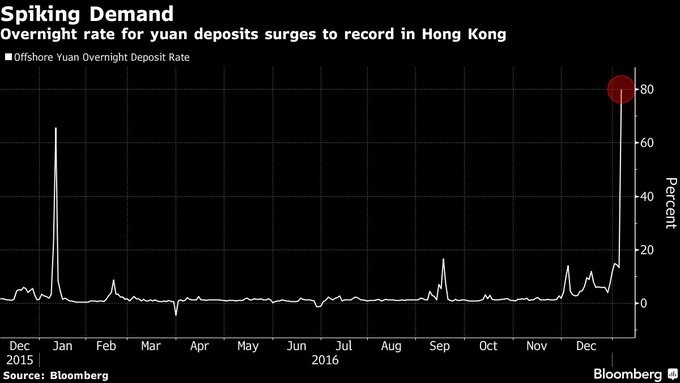

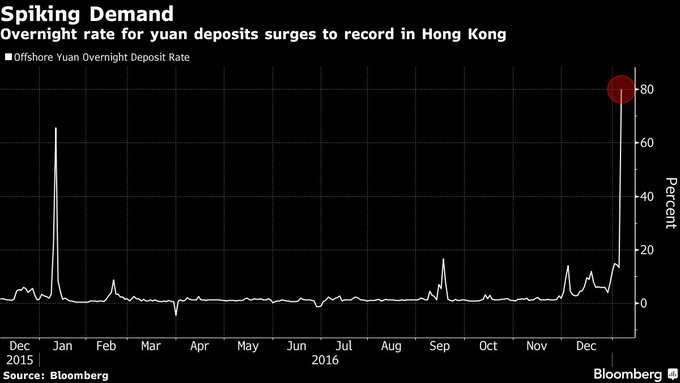

ReggieMiddleton @ReggieMiddletonAnd more to this theory, @Bloomberg "Bears Scramble for Yuan as China Chokes Flows, Aids Currency". China hits $BTChttps://www.bloomberg.com/news/articles/2017-01-05/bears-scramble-for-yuan-as-china-chokes-flows-supports-currency …

9:00 AM - 5 Jan 2017

- Retweets

- 11 like

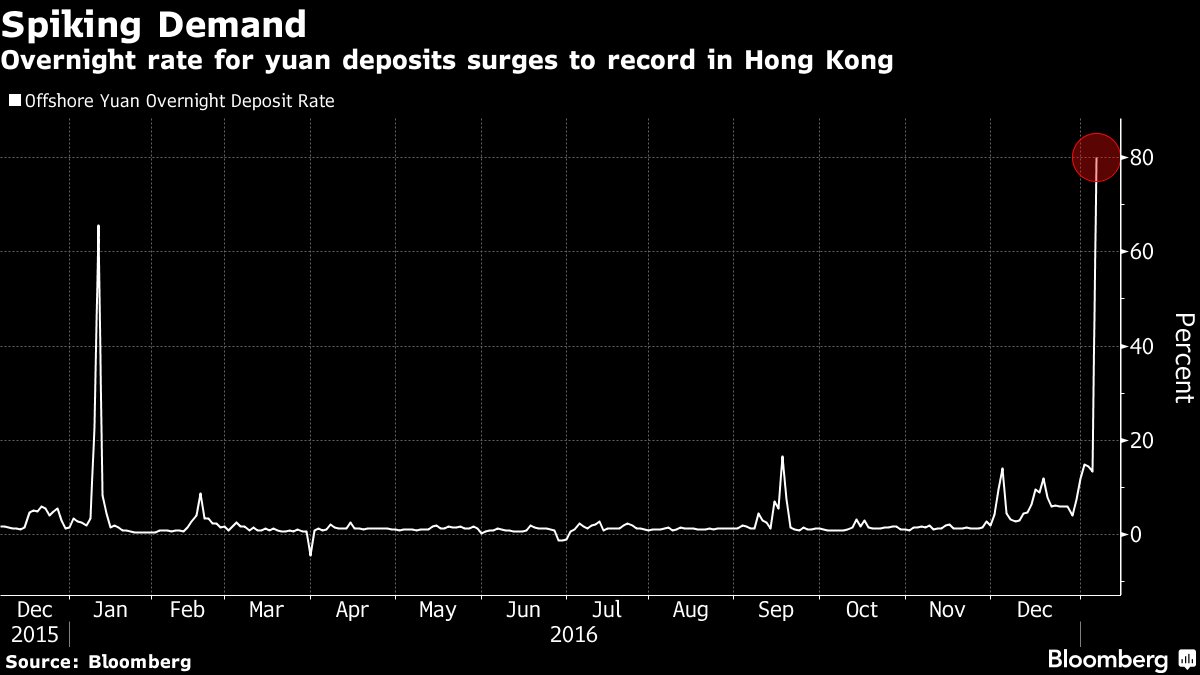

Here comes the benefit of doing macro analysis. It all fits in...

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonAlready experts crying #bticoin #crash without knowing facts: Offshore $CNY set for biggest 2-day gain on record, deposit rate jumps to 80%

9:03 AM - 5 Jan 2017

- 55 Retweets

- 55 likes

China is painting itself into a corner with thier old school policies on capital controls... The amount of money they are spending is stupendous. The problems is, no matter how much they spend, the fundamentals are still going to be the fundamentals.

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonAttn: #Bitcoin naysayers, learn your macro/fundamentals/tech. https://China.gov painting itself into a corner, this may be a $BTC oppo

9:07 AM - 5 Jan 2017

- 22 Retweets

- 77 likes

Of course, in the short run, their brute force methodology is working as yuan spikes and availability offshore dwindles.

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddleton$CNY >0.5% 6:48 p.m. HK time, 2 day move 1.8%, poised for biggest gain in data going back to 2010. Overnight deposit rate in HK record 100%

9:12 AM - 5 Jan 2017

- Retweets

- 22 likes

Here you go...

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonOffshore/onshore $CNY rates widest since 2010. @Bloomberg: https://China.gov urged state-owned enterprises to sell foreign currency.

9:15 AM - 5 Jan 2017

- Retweets

- 11 like

I suppose a little strongarming doesn't hurt, no?

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonChannels for domestic institutions, retails to bring out onshore cash to the offshore market tightened,” “Lack of supply of yuan liquidity.”

9:19 AM - 5 Jan 2017

- Retweets

- 11 like

The problem is, when you have to go to such extreme measures to draw currency back into the country, it becomse quite obvious to the prudent speculator that...

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonCapital controls aren’t working when you raise overnight deposit rate to 100%! https://China.gov telegraphing weakness to speculators

9:21 AM - 5 Jan 2017

- 11 Retweet

- 22 likes

Like I said earlier it will obviously work for the short run, but in the medium term, look out below!

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonWhile https://china.gov will burn short term shorts with high funding costs and spiking $CNY, we all know they can't keep this up 4EVA

9:23 AM - 5 Jan 2017

- 55 Retweets

- 33 likes

The Chinse are painting themselves into a tight corner, and telegraphing it to boot.

[image]https://mhmarketingsalesmanagement.com/blogs/tonykovach/wp-content/uploads/2013/03/painted-into-a-corner-credit-canaconcepts-.gif[/image]

Follow

ReggieMiddleton @ReggieMiddletonRemember the Chinese (& EU) Trilemma I outlined in Veritaseum Currency War, part 1. They're trapping themselves https://blog.veritaseum.com/current-analysis/1-blog/83-despite-what-you-don-t-hear-in-the-media-it-s-all-out-currency-war-pt-2 …

9:27 AM - 5 Jan 2017

- Retweets

- 22 likes

Follow

ReggieMiddleton @ReggieMiddletonThe fundamentals behind $CNY depreciation, ie. capital outflows borne from dwindling economy & Trump’s China policies haven’t changed.

9:31 AM - 5 Jan 2017

- 22 Retweets

- 11 like

This is probably the most important tweet of the series. The FUNDAMENTALS HAVE NOT CHANGED!!! No matter how much money China spends, or how draconian they decide to become to trap capital, it's all about the fundamentals, silly!

Follow

ReggieMiddleton @ReggieMiddletonFundamentals behind $CNY drop haven’t changed, but something will - https://China.gov foreign reserves! Unsustainable intervention!

9:41 AM - 5 Jan 2017

- Retweets

- 22 likes

Follow

ReggieMiddleton @ReggieMiddletonhttps://China.gov FX reserves may drop below pscyhological $3 trillion line. Trilemma says Beijing can't defend yuan & free float

9:46 AM - 5 Jan 2017

- 33 Retweets

- 11 like

This is the Trilemma in effect!

Follow

ReggieMiddleton @ReggieMiddletonTrilemma & math also say https://China.gov intervantion + FX reserve burn means reinforcing cycle of outflows & currency depreciation

9:49 AM - 5 Jan 2017

- Retweets

- likes

Follow

ReggieMiddleton @ReggieMiddletonhttps://China.gov repeatedly intervened to support $CNY as it weakened, burning half trillion of reserves & selling UST holdings

9:53 AM - 5 Jan 2017

- Retweets

- likes

We've seen this movie a few decades before. Remember when the Band of England was determined to join the EMU by any means necessary? They said they would defend the pound no matter what, foolishly and simultanesouly telegrpaphing the promise to feed trades from macro funds such as Soros & Co. all day long. So guess what? That's exactly what happened until the BOE tapped out, permanently pushed out of the EMU. As it turned out, that was actually a good thing for the Brits, but that's a story for another time. If you really must here the reason, view...

Follow

ReggieMiddleton @ReggieMiddleton#IMF (US controlled) has minimum $2.6T capital adequacy 4 https://China.gov , meaning 1 more $500B FX manipulation spree & they breach

9:58 AM - 5 Jan 2017

- 22 Retweets

- 33 likes

Follow

ReggieMiddleton @ReggieMiddletonSince Fundamentals behind $CNY decline aren't going anywhere reserves continue 2 B depleted, capital flight continues. What does that mean?

10:01 AM - 5 Jan 2017

- 11 Retweet

- 66 likes

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonhttps://China.gov currency devaluations = #CurrencyWar3.0 as #BOJ#ECB #BOE (Brexiters) struggle to keep up https://blog.veritaseum.com/current-analysis/1-blog/83-despite-what-you-don-t-hear-in-the-media-it-s-all-out-currency-war-pt-2 …

10:05 AM - 5 Jan 2017

- Retweets

- 11 like

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonIgnore naysayers who don't know macro, fintech nor fundamentals say #Bitcoin is crashing as I time this on BoomBustblog. Opportunity awaits

10:08 AM - 5 Jan 2017

- 11 Retweet

- 33 likes

5 Jan

ReggieMiddleton @ReggieMiddletonIgnore naysayers who don't know macro, fintech nor fundamentals say #Bitcoin is crashing as I time this on BoomBustblog. Opportunity awaits pic.twitter.com/ep9XSjFN6A

Follow

The Bitcoin Rat @BitcoinRat@ReggieMiddleton each time bitcoin is declared "dead" .... its at a higher price than the last death !there's a lesson there for sure pic.twitter.com/DFFEGHfLyL

10:11 AM - 5 Jan 2017

- 22 Retweets

- 55 likes

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonFed economists materially more pessimistic than sitting policymakers, the ones who actually make the call on rateshttps://ow.ly/rKTT100xQCZ

3:14 PM - 5 Jan 2017

- Retweets

- 11 like

View image on Twitter

Follow

ReggieMiddleton @ReggieMiddletonAddressing naysayers saying #Bitcoin crashing: crashes see dearth of buyside liquidity. $BTC has ultra tight .001% spreads Many $BTC buyers

3:51 PM - 5 Jan 2017

- 1616 Retweets

- 2424 likes

5 Jan

ReggieMiddleton @ReggieMiddletonAddressing naysayers saying #Bitcoin crashing: crashes see dearth of buyside liquidity. $BTC has ultra tight .001% spreads Many $BTC buyers pic.twitter.com/fjACxl8Bd1

Follow

Chris Rees @Gitsyreeves@ReggieMiddleton This is why I follow you, I don't see anyone else with this kind of excellent analysis. Helps with my longterm focus.

6:13 PM - 5 Jan 2017

- 11 Retweet

- 55 likes